The New Fund Order

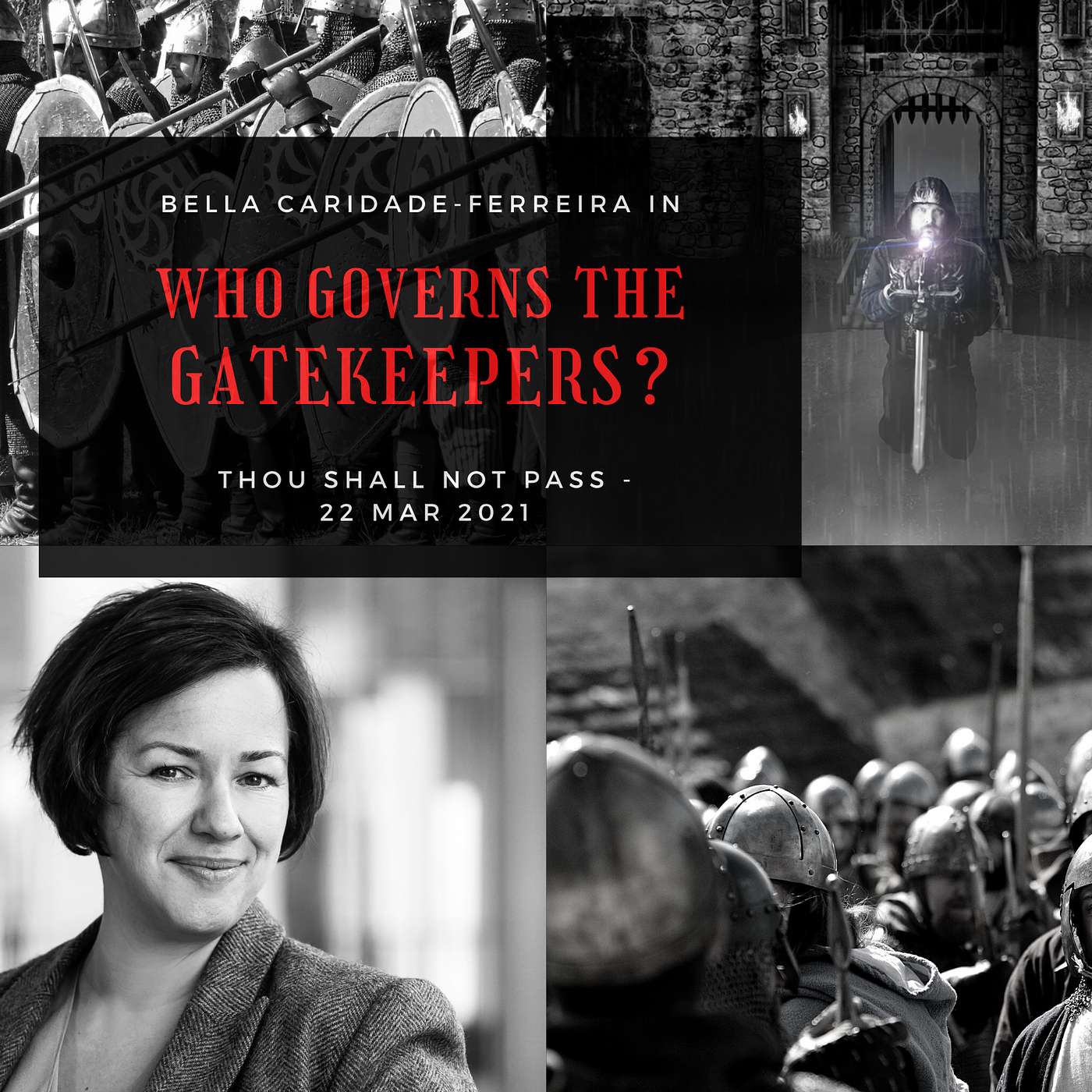

Thou Shall Not Pass: Who Governs the Gatekeepers?

Welcome to the New Fund Order. An Orwellian journey into the Darkside, the Frontier and the Fringe of Finance.

Picture a dark night.. rain pours down the ramparts as a storm thunders in the distance.. the light picks up the horde; an army of wannabe fund managers and eager asset-deprived boutiques descend upon the fortress walls. Yet before them stands a warrior, a knight, a paladin, a Gatekeeper to test them.. who proclaims 'Thou Shall.. Not.... Pass!!!!'

Join us into the mud, the murk, this gothica come rock opera.. the world of Fund and investment Gatekeepers. Who are they, what do they do and... are they any good?

Billions of assets are being managed and influenced by powerful fund gatekeepers. If you are not on their list then you are definitely not getting in. So many have fallen in this distribution blood-soaked field.. yet who governs the Gatekeepers? With ever centralised investment propositions and the rise of model portfolio services, as an industry we face regulatory arbitrage, asset concentration, a climate crisis, momentum markets, group think and star manager biases.

Our safe pathfinder through this battlefield is Bella Caridade-Ferreira, founder of Fundscape as we discuss the revelations of her Gatekeeper study... a most gory affair where more than one poor soul might lose their head..

Together with left-field opinion, global market news and latest views, direct from my dystopian bunker. In the Air, on the Ground, on the Street and around the corner of Debate. Watching, listening, in the Shadows and on your Airwaves. For Fund Selectors, distributors, wealth managers and investors.

In association with my sponsor Allianz Global Investors (AGI) one of the world's leading active managers. My thanks to my guest Bella and Fundscape.. and you dear listener.

Please LIKE, SHARE and SUBSCRIBE. Please leave a REVIEW and let me know what you think and what topics you would like for future episodes. Until then... stay safe and.. keep it left-field!!

That's 20 episodes, 20 Guests, every 2 weeks... each episode is 25 minutes!

Join the NFO Army Citizen, https://www.patreon.com/newfundorder

Left-field Finance.

#newfundorder

Credits;

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Public domain 1.0, 'Ivanhoe' (1952), directed by Richard Thorpe, produced by Pandro S. Berman for Metro Goldwyn-Mayer, based on the book (1819) 'Ivanhoe' by Sir Walter Scott.

Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0.

All additional Music used by Silvermansound.com Attribution 4.0 International (CC BY 4.0)

Allianz Global Investors (AGI)

Active is: Allianz Global Investors.

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

Welcome to the New Fund Order. An Orwellian journey into the Darkside, the Frontier and the Fringe of Finance.

Picture a dark night.. rain pours down the ramparts as a storm thunders in the distance.. the light picks up the horde; an army of wannabe fund managers and eager asset-deprived boutiques descend upon the fortress walls. Yet before them stands a warrior, a knight, a paladin, a Gatekeeper to test them.. who proclaims 'Thou Shall.. Not.... Pass!!!!'

Join us into the mud, the murk, this gothica come rock opera.. the world of Fund and investment Gatekeepers. Who are they, what do they do and... are they any good?

Billions of assets are being managed and influenced by powerful fund gatekeepers. If you are not on their list then you are definitely not getting in. So many have fallen in this distribution blood-soaked field.. yet who governs the Gatekeepers? With ever centralised investment propositions and the rise of model portfolio services, as an industry we face regulatory arbitrage, asset concentration, a climate crisis, momentum markets, group think and star manager biases.

Our safe pathfinder through this battlefield is Bella Caridade-Ferreira, founder of Fundscape as we discuss the revelations of her Gatekeeper study... a most gory affair where more than one poor soul might lose their head..

Together with left-field opinion, global market news and latest views, direct from my dystopian bunker. In the Air, on the Ground, on the Street and around the corner of Debate. Watching, listening, in the Shadows and on your Airwaves. For Fund Selectors, distributors, wealth managers and investors.

In association with my sponsor Allianz Global Investors (AGI) one of the world's leading active managers. My thanks to my guest Bella and Fundscape.. and you dear listener.

Please LIKE, SHARE and SUBSCRIBE. Please leave a REVIEW and let me know what you think and what topics you would like for future episodes. Until then... stay safe and.. keep it left-field!!

That's 20 episodes, 20 Guests, every 2 weeks... each episode is 25 minutes!

Join the NFO Army Citizen, https://www.patreon.com/newfundorder

Left-field Finance.

#newfundorder

Credits;

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Public domain 1.0, 'Ivanhoe' (1952), directed by Richard Thorpe, produced by Pandro S. Berman for Metro Goldwyn-Mayer, based on the book (1819) 'Ivanhoe' by Sir Walter Scott.

Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0.

All additional Music used by Silvermansound.com Attribution 4.0 International (CC BY 4.0)

Allianz Global Investors (AGI)

Active is: Allianz Global Investors.

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

Clip from 'Ivanhoe' (1952) 0:05

I was wrong to let you coax me here only grief can come of it.

What's this another challenger?

Your name Sir Knight... or your Degree?

JB Beckett 0:26

Salutations Dear citizens as we peer into the new fund order to discover the immutable truth for asset management and wealth managers,

The lowdown from the dark side, the frontier and the fringe of asset management and fund research.

A podcast for wealth managers, fund selectors, distributors and investors. Bringing to you the People's Republic podcast of finance, in association with my sponsor Allianz Global Investors, capturing the latest market news, views and interviews with leading minds in our industry.

Allianz Global Investors is one of the world's leading active managers.

In this episode.. 'thou shall not pass'... Gatekeepers....

Those whom stand between the fund managers and investors. We talk with Bella founder of Fundscape.. in 2010, she established Fundscape a research house specialising in the end to end analysis of the UK fund industry.

Earlier in her career Bella worked in investment banking and then a London based consultancy firm where she specialised in market entry strategies for fund managers. Prior to Fundscape, Bella worked for Lipper FMI, a Thomson Reuters company and now Refinitiv, as Global Head of research and publications,

Running since 2015, Fundscape's 'Gatekeeper' study shines a light on the opaque and murky world of gatekeepers, fund selectors and investment influencers. They influence more than 70% of all platform flows and in adverse markets that proportion is considerably higher, their reache is significant, regardless of how good or bad they are. Funds that aren't on the gatekeepers radars are losing out on substantial flows. So just who are the gatekeepers? How well do fund distributors understand what they do, indeed, how well do investors understand what gatekeepers do?

Computer 2:52

Market news,

JB Beckett 2:53

The editor in chief for money week runs with a story 'are markets bubbling over?' Is there a bubble in the stock market he asks, it depends how you judge a bubble. If you just look at valuations in say the US tech sector, or perhaps the global renewable energy sector, there is no shortage of bubble signals.

Meanwhile, IPE runs with a story about AP4 for the Swedish pension fund which has been countering flak over its fossil policy. 'We have clear ownership criteria' AP4 has defended itself against criticism levelled at it and most of Sweden's other national pension funds - that their policy of engaging with fossil fuel companies was not working.

The institutional investor group for climate change, the IIGCC has launched its 'net zero' framework, which cover 22 asset owners amounting to $1.2 trillion in committing to achieve net zero alignment with the Paris aligned investment initiative.

The OECD, a club for developed countries now expects GDP growth of 3.9% this year, much less than a 5.1% it had pencilled in for UK. Eurozone output shrank by 0.7% quarter and quarter in the final three months of 2020.

The Times reports that Bitcoin fell back sharply. India is mulling the introduction of a strict ban on such digital assets.

BBC report that Elon Musk has dropped his chief executive job title and crowned himself 'TecknoKing of Tesla'. Tesla's Chief Financial Officer Zack Kirkhorn has the new title of 'Master of Coin'. This may refer to the company's $1.5 billion purchase of Bitcoin this year.

BBC also reports the US and its allies should reject calls for a global bond on AI powered autonomous weapon systems. According to an official report commissioned for the American President and Congress. It says that "artificial intelligence will compress decision timeframes and require military responses humans frankly cannot meet quickly enough alone", and it warns Russia and China would be unlikely to keep to any such treaty.

And lastly, money week reports 'drought dries out chip sector' a worsening drought is threatening Taiwan semiconductor manufacturing sector, the crown jewel of the island's economy say Cheng-Ting Fang and Lauly Li on Nikkei Asia, the island is going through its worst drought in decades and the government tightened water use at the end of February, asking manufacturers in several cities to cut consumption by 7%. Taiwan is the world's largest base for chipmakers, which power everything from cars and phones to servers and games consoles. Chip production requires large amounts of water, but reservoirs on the island are at a critical stage. And that's the end of the news tag #newfundorder. And let me know what news stories you want to hear.

Computer 5:32

Interview, interview, interview, interview...

JB Beckett 5:37

And in these strange pandemic lockdown times, rest assured that all guests are calling in remotely.

And welcome to the new fund order Bella. Let's talk about those fund and investment gatekeepers. Great to have you on board.

Bella 5:56

Oh great. Great to be here. Thank you very much.

JB Beckett 6:00

And I've obviously I do my research. You know, before I speak to my guests, and I was reading the the 2019 gatekeeper study, Bella, and you noted if fund groups aren't on gatekeepers radars, they could be missing out on substantial flaws.

So to start us off Bella, firstly, how would you define a fund gatekeeper to those listeners who don't know what they are? Who are they? I guess then that may be naturally leads us on to why launch a gatekeeper study a few years ago?

Bella 6:31

So 'Gatekeeper' is an individual or a company that influences investment selection in some way, shape or form, right? So it's anything from a D2C recommended fund list to a bespoke DFM. So you've got advisor lists, you've got platform lists, D2C platform lists. The whole kaboodle, anywhere where there's some kind of influence or some kind of commentary or fund selection: that is a gatekeeper. In social media parlance they're called influencers, I suppose. And as we can see from social media influencers all those 'insta' influencers, they have the power to move markets. So it is really important that we know what they doing.

JB Beckett 7:14

This whole idea, this world of the gatekeepers, which sounds terribly clandestine, and very dark, which obviously plays to my my Gothic nature, you noted that gatekeepers that world is quite opaque and that many clients will simply not know what they do. And of course, intermediation and remoteness are, of course, a reoccurring theme of our industry. In terms of gatekeeper studies, they seem quite rare. You know, what effect is bringing transparency to the world the gatekeepers had?

Unknown Speaker 7:46

So I suppose the biggest revelation to me was disappointment, really, because it confirmed my thinking. And what it confirmed is that, you know, the vast majority of fund selectors are just doing the same as everybody else in picking the safe large funds that they know they can get away with, brand is everything. And that's, you know, that's, that's a, that's a problem really. What we found is that there was sort of several funds or fund managers with a huge number of gatekeeper picks, and then a very, very long tail of funds with one or two funds. Now, I can understand that, in some cases, if you are a very large DFM or a large model portfolio or something, then you're going to have to be careful about the funds you pick, because you could overwhelm that fund if it's a small fund. And so there's there's obviously an argument for being careful about the funds you pick and so on. But there are ways around that. There's definitely ways around that. I think the for me that the really stark thing is that, you know, if you looked at our gatekeepers analysis, you looked at a fund, or the funds in a sector by the number of picks it had, and then you looked at the funds.. with the best performance, often there was no correlation between the two. And you know, and sometimes you know, there is an essence there is a, in essence, a laziness, they've already you know, that picking funds, putting them into a model, and then picking them based on the fact that it's a brand that they know, and that perhaps, you know that that brand has the resource to send out people and promote that product. So I think that was, for me, the biggest revelation was that there was such a lack of diversity and thinking among, among the gatekeepers. And I've seen that we've seen this in other studies that we've done, we've deconstructed funds of funds, and exactly the same thing happens and then the fund pf funds, you know, again, you shouldn't happen, you know, again, they're selecting funds that should be able to cope with their flows. But even there, you know, despite all the all the bollocks about diversification, we found that more than 60% of you funds, the funds are actually invested in UK funds so so much for f**king diversity.

JB Beckett 10:08

Does that point to and, you know, later in the season, I've got Bev Shah coming on to I guess talk about diversity and gender equality generally within fund management, but in terms of those gatekeepers, does that point to some inherent biases? And could the perhaps the problem be there is that there's just not enough diversity among the gatekeepers themselves?

Bella 10:32

I really do think it's just down to a lack of independent thinking, and it's sticking to a particular way of working, let's choose these and clearly this is a way of working that comes from decades ago, you know, when you got paid, you selected the fund based on the funds that paid you that best commission, and that still affects the way things work today. So because brands, everything else, are still being picked for anachronistic reasons. I mean, I like to use the analogy of, I'm a great one for analogies. And I would I like to compare our industry to the high street, okay, the high street, we've lost all those small, independent boutiques, they've been priced out of the market, and there are plenty of gatekeepers out there who are now starting to go actually, you know, they come into us and looking at our gatekeeper work, and think and so I'm actually I don't want to be picking the same funds as another big provider, I want to make sure that you know that there is no systemic risk in the funds that I'm picking.

The big difference between a gatekeeper and the fund manager is, is a big one. Gatekeepers don't actually have to have any qualifications to pick funds. And this is really an important factor that we have to remember. Any Tom, Dick or Harry can come along and put a list together and say 'here you go', of course, anyone you know, as human beings, we always assume that if we look at a list that's been put together, that some some thought and attention and care has gone into that actually could have got a monkey to pick them out of newspaper, because often, that's what it looks like when you look at the quality of these lists.

JB Beckett 12:22

But you don't sound terribly optimistic about the adaptability of the of the gatekeepers themselves, right. And also just this rapid change in the face of technology and how technology is being used in the industry. Are they adapting to that? Are they adapting to, for example, adopting, you know, embracing, for example, index or innovative exchange traded funds.

Bella 12:47

No, not really. I mean, for example, if you look on compare the platform, and you look at all the D2C providers or the Robos that do ESG type portfolios, they are more expensive. So immediately, you know, there's a minimum investment for for example, for some the 5000 on a Robo, there's just not enough time has gone by, for those for the ESG factors to be commonplace, and therefore, there be no difference in for an investor, whether it is just an ordinary fund, whether it's an ESG fund.. that should be, that should be completely, what's the word they should be measured on, they should be measured on on a level, they should be on a level playing field, but it's still not there. And so for some investors who are looking at these different things, they might be driven by ESG factors, but it still comes down to affordable that funds expensive, you know, the funds ESG many of the really good ESG funds have higher OCF much higher OCFs. And mainly because they're also actively managed here to run a fund properly. An ESG fund properly. You do need active management, or certainly there's no way the proper way yet of alternating all those different factors that contribute to, to how how ESG a fund really is. We haven't quite found the algorithms yet, maybe in 5, 10, 15 years that will capture but right now it's pretty difficult. You know, for example, knowing understanding how companies and voting, you know, have funds and voting, that sort of information is manual, you've got to go and get input to input it manually. So it's not it's not straightforward. Hopefully one day we'll see. We'll see that we'll see that change.

JB Beckett 14:50

Now. It's one thing Bella in terms of these gatekeepers floating along in the sea of mediocrity, you know, somewhat aloof and safe from some of the big secular forces that are happening in the world, it's another when funds blow up on their watch. And of course, we've had a number of blow-ups across Europe, including obviously Woodford, which obviously garnered a huge amount of press attention, but also gam, also h2o. And thinking about I guess the pressure that was put on, you know, one gatekeeper, for example is Hargreaves. What effect did Woodford have on the gatekeeper community on Hargreaves? And do you think gatekeepers actually stopped and recognised the part that they played in it?

Bella 15:36

You know, I'm isn't just Gatekeepers' role in the Woodford affairs also the media's role, because that constant scrutiny of Hargreaves led everyone to think that only Hargreaves Lansdown had that fund on its list. Until the end, it was not the only one. There were lots of others. When when the fund was suspended, we still had eight lists with that fund. So I don't really want to talk about the 'names', but some big names and they just got away with with not being mentioned. And of course because everyone likes to bash Hargreaves Lansdown because it's the biggest D2C platform in the country, and it tends not to say very much. So everyone wants to bash it there's a there's a few things. I mean, I think, I think what I'm about to say is probably not very, is not going to be very popular with people. But you know, for Woodford funds, had it been left to carry on, you know, it to carry on with its investment strategy.. probably would have been would would have worked out okay. But Link pulled the rug from underneath it. And it triggered a whole host of decisions, sell offs, etc, etc. Whereas I actually think that some of those bets that he'd made, if they've been allowed to play out would have worked. But media, the media, the news that the unprecedented attention on it just meant that that couldn't happen.

JB Beckett 17:21

But if there's that level of doubt, I mean, we're talking about the challenges of gatekeepers, we've talked about the mediocrity at times of gatekeepers. We've talked about the blow ups and yet, why do investors pension schemes, financial advisors continue to trust gatekeepers? Should they just try to select the funds themselves?

Bella 17:40

God no.... I mean, look, you know, like anything, there's just, there's just too much choice. People are overwhelmed, right. And if you've got a handful of let's say, there's about 200, gatekeepers in the industry that are influencing how the industry works, if they get it wrong, a lot of the times and they do how the hell are the rest of us going to get it right. You know, we can week out month in month out, year in year out is just impossible. But we do need to there are two major, the problem is that there are far too many firms in industry. So really, we should you know, I mean, if you look at the European industry, that's 45-50,000 funds. Compare that to the US where there's probably 15,000, there's a big difference already, there's far too many firms doing the same thing. So a lot of these firms should be, should be closed, you got rid of it in some way, shape, or form. So there's too much selection, too much choice. And as we know, too much choice make people freeze like rabbits in headlights. So and that's why gatekeepers and selectors also facing that problem is that we are set we assume that we make keepers are the same. And there's a huge difference between someone who just opens a newspaper and picks out a few funds and put some piece of paper and the ones who do a huge amount of research. So you know, interestingly, when we look at all the different gatekeeper cohorts in our study, what we found is actually as a cohort, the best ones are the D2C ones, because they're the ones we're looking to consumers and the investors in the eye. And basically something that they've got to nail their colours of the mast. And say, 'we selected these funds'. And as we saw from the Hargreaves Woodford fall-out and if they had, had a bit of a backlash against that. But as it will because of that, because they are so conscious of the fact that they're having to deal with customers and they can lose those customers really easily. On the whole, that's a far better, they're far better fund pickers than anybody else, and other people.

JB Beckett 19:57

Yeah, and of course, as you say a number of gatekeepers.. And I'm thinking here, Bella things like model portfolio service providers? Are the MPS sufficiently transparent? And do they need to be regulated more?

Bella 20:10

Yes, yes.

Sorry, 'no' that they're not sufficiently transparent? And 'yes' they do need to be regulated. Same thing. It's a bit like the, you know, these value assessment reports that we've done all the fund managers have to do..

Your asking fund managers to assess their own funds, and some of them are patting themselves on the back and saying 'you're doing a fab job well done'. Others have been pretty good, and looking at their own funds and, and acting on what they found. So they're making it part of their, they're integrating it into their everyday process. And that's the interesting thing is that fund managers have assessment of value reports, but we don't have the same thing with model portfolios. And if you, if you know that around 50% of all flows, at least 50% of all flows in the platform industry are going into some kind of model portfolio, then it makes the assessment of the value on individual funds totally irrelevant, because what matters is how that model portfolio works together in one and how that is assessed. So a lot has to be done. We also need to evaluate, people need to be able to evaluate model portfolios and rank them and compare them and contrast them to others. And that's really what we want what we are trying to do with the gatekeepers study.

That is essentially what we want to do is to list all that is to is to list all types of model portfolios in in one place, against different criteria. Because if someone, if a model portfolios CPI plus three, or CPI plus four or whatever, then you should be able to evaluate models against similar models, much in exactly the same way as you would with a fund. There's literally no difference between evaluating funds and and evaluating model portfolios. I mean, it's ridiculous to think that a fund manager could have a multi asset fund that you know, has to produce performance stats and all sorts of things, but it doesn't have to do the same for a model portfolio.

JB Beckett 22:32

Look before I let you go Bella, I'm afraid I do subject all guests to my 10 question rapid fire round, plus, one bonus question. And if you are ready, we shall begin.

Bella 22:34

Gosh I'm scared.

JB Beckett 22:51

Okay, nice and easy nice and easy. Here we go.

Question one Bull or Bear?

Bella 22:57

Bull.

JB Beckett 22:59

Question two.. Bogle or Buffett?

Bella 23:03

Bogle.

JB Beckett 23:05

Question three, profit or planet?

Bella 23:08

Planet.

JB Beckett 23:09

Question four, divest or engage?

Bella 23:12

Engage.

JB Beckett 23:13

Question five, lower cost or better value?

Bella 23:17

Lower cost.

JB Beckett 22:51

Question six.. supertankers or boutiques?

Bella 22:51

Boutiques.

JB Beckett 22:51

Question seven.. star managers or team players?

Bella 22:51

Team players.

JB Beckett 22:51

I had a sneaky feeling you'd go for team players.

Question eight, public or private?

Bella 23:22

Private

JB Beckett 23:34

Question nine, high growth or stable income?

Bella 23:42

Stable income

JB Beckett 23:43

and question 10 socialism or free markets,

Bella 23:46

free markets.

JB Beckett 23:50

And then we've got this one last bullish pick a number between a living on 40 for me,

Bella 23:57

33

JB Beckett 23:57

is an easy question. 33 jazz or pop?

Bella 24:00

Oh, pop

JB Beckett 24:01

there you go.

Bella 24:02

I love a bit of disco and pop.

JB Beckett 24:04

You have been a fantastic guest, Bella, thank you very, very much for joining the new fund order and indeed surviving it. Thank you ever so much.

Bella 24:15

Thank you for having me.

JB Beckett 24:16

Please don't forget to Like and Share and Subscribe. You don't click the subscribe button. A new podcast every two weeks with a new guest. Stay tuned.

So as fund gatekeepers, how do we meet the challenges and criticism posed by Bella in her fund gatekeepers report? Well, firstly, I think we have to actually address that we need more regulation in fund gatekeepers. And obviously in terms of model portfolios and fund buy lists. Secondly, we need more governance we need to create an outsourced independent committees we need more monitoring performance, ESG factors persistency, liquidity, churn and the risks and how those are reported in terms of the models and indeed how do they add value to investors. And then lastly, I think the fund gatekeepers need to be direct full PRI signatories (principles of responsible investment) and report something that is resembling the PRI module five 'selection appointment and monitoring', which would move them on from the platitudes into positive change.

Drop me a comment let me know what you think of the fund gatekeepers study. What do you think to the views raised today? And more importantly, how do we move forward in terms of being fund gatekeepers?

A big thanks to you, dear listener for tuning in, brought to you by my sponsor, Allianz Global Investors. and a warm thanks to today's guest, legally, I am compelled to remind everyone that all views of this podcast are of course 'independent' and do not belong to any affiliation or organisation. Just in case that was in any doubt.. Tune in for the next podcast every two weeks from the new fund order. Please subscribe, share, like and comment. Let me know what you think. What you'd like covered in future episodes.

Until then, stay safe and keep it left field.

Clip from 'Ivanhoe' (1952) 26:04

Black from hoof to plume the.. nave. Soon be bright with blood your highness

..his homage was to beauty not to faith I fear

Transcribed by https://otter.ai