The New Fund Order

Boutique Budo: Measure Twice, Cut Once!

Welcome to the New Fund Order. An Orwellian journey into the Darkside, the Frontier and the Fringe of Finance.

In this special episode, enter the dojo with Gandy Gandidzanwa of Conceptual as we slice through the first 7 samurai episodes of the NFO podcast.

When it comes to selecting boutique asset managers is it really a case of 'measure twice, cut once'? Gandy and I confront the insights and revelations from previous guests on asset concentration to; supertankers, technology disruption, equity styles, value, gatekeepers, star managers, professionalism, fund costs, existentialism, risk and governance.

All Episodes are available on Newfundorder.Buzzsprout.com.

Together with left-field opinion, global market news and latest views, direct from my dystopian bunker. In the Air, on the Ground, on the Street and around the corner of Debate. Watching, listening, in the Shadows and on your Airwaves. For Fund Selectors, distributors, wealth managers and investors.

In association with my sponsor Allianz Global Investors (AGI) one of the world's leading active managers. My thanks to my guest Gandy and Conceptual.. and you dear listener.

Please LIKE, SHARE and SUBSCRIBE. Please leave a REVIEW and let me know what you think and what topics you would like for future episodes. Until then... stay safe and.. keep it left-field!!

That's 20 episodes, 20 Guests, every 2 weeks... each episode is 25 minutes!

Join the NFO Army Citizen, https://www.patreon.com/newfundorder

Left-field Finance.

#newfundorder

Credits;

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Public domain 1.0, 'Seven Samurai' (1954), directed by Akira Kurosawa, produced by Sojiro Motoki for Toho. Film music clip by Fumio Hayasaka

Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0.

All additional Music used by Silvermansound.com Attribution 4.0 International (CC BY 4.0)

Allianz Global Investors (AGI)

Active is: Allianz Global Investors.

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

Welcome to the New Fund Order. An Orwellian journey into the Darkside, the Frontier and the Fringe of Finance.

In this special episode, enter the dojo with Gandy Gandidzanwa of Conceptual as we slice through the first 7 samurai episodes of the NFO podcast.

When it comes to selecting boutique asset managers is it really a case of 'measure twice, cut once'? Gandy and I confront the insights and revelations from previous guests on asset concentration to; supertankers, technology disruption, equity styles, value, gatekeepers, star managers, professionalism, fund costs, existentialism, risk and governance.

All Episodes are available on Newfundorder.Buzzsprout.com.

Together with left-field opinion, global market news and latest views, direct from my dystopian bunker. In the Air, on the Ground, on the Street and around the corner of Debate. Watching, listening, in the Shadows and on your Airwaves. For Fund Selectors, distributors, wealth managers and investors.

In association with my sponsor Allianz Global Investors (AGI) one of the world's leading active managers. My thanks to my guest Gandy and Conceptual.. and you dear listener.

Please LIKE, SHARE and SUBSCRIBE. Please leave a REVIEW and let me know what you think and what topics you would like for future episodes. Until then... stay safe and.. keep it left-field!!

That's 20 episodes, 20 Guests, every 2 weeks... each episode is 25 minutes!

Join the NFO Army Citizen, https://www.patreon.com/newfundorder

Left-field Finance.

#newfundorder

Credits;

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Public domain 1.0, 'Seven Samurai' (1954), directed by Akira Kurosawa, produced by Sojiro Motoki for Toho. Film music clip by Fumio Hayasaka

Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0.

All additional Music used by Silvermansound.com Attribution 4.0 International (CC BY 4.0)

Allianz Global Investors (AGI)

Active is: Allianz Global Investors.

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

Clip from Seven Samurai (1954) 0:20

----------

JB Beckett 0:20

Podcast 008

Salutations Dear citizens as we peer into the new fund order to discover the immutable truth for asset management and wealth managers, the lowdown from the dark side the frontier and the fringe of asset management and fund research.

A podcast for wealth managers fund selectors, distributors and investors. Bring it to you the People's Republic podcast on finance, in association with my sponsor Allianz Global Investors, capturing the latest market news, views and interviews with leading minds in our industry.

Allianz Global Investors is one of the world's leading active managers.

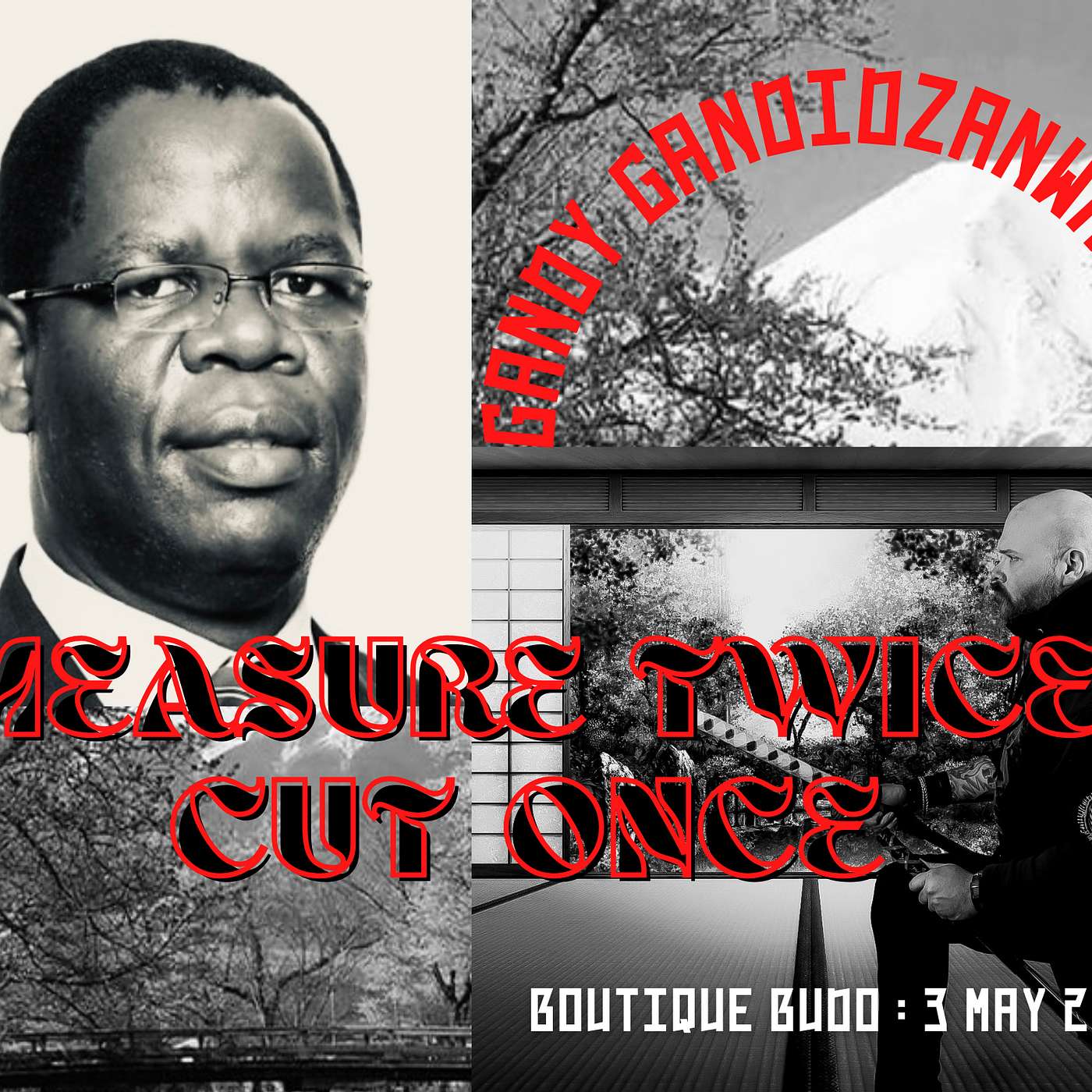

Joining me in the dojo is Gandy Gandidzanwa from Conceptual. He was previously principal executive officer of NMG Smart fund, an emerging market investment specialist, Board of Directors member for the Association of Professional Fund Investors Ambassador for the Transparency Task Force and managing director for Conceptual Fund Managers Limited

and in these strange pandemic lockdown times. Rest assured that all guests are calling in remotely..

Welcome to your citizens to the new find order. This episode 'Boutique Budo' when it comes to emerging managers is about 'measuring twice and cutting once'

and welcome to the new fund order Gandy. 'Seven may fall but eight will rise' or so the Seven Samurai story goes. Over the last several weeks I have assembled Seven Samurai for you to consider and how they may apply to your market, and I guess more globally, it's great to have you on the show Gandy and welcome aboard.

Gandy 2:21

Thank you very much, JB. It's great for them to have me here. And good afternoon. Good morning. Good evening to your listeners from all over the world.

JB Beckett 2:32

Yeah, it's great to have you aboard Gandy. I've been really looking forward to this episode, and I think we're gonna have some fun with

Gandy 2:38

Looking forward to it.

JB Beckett 2:39

So I'm just gonna throw us straight in Gandy, I've got seven main questions for you. And of course, then I've got my, my little bonus round, my little rapid fire round at the at the end, whichever one obviously really loves to hate.

So let's get started with the first question. In Episode One, I was discussing value equity investing with Dan Kemp at Morningstar. And he said value was not so much a matter of faith, but actually a matter of fact, and that ultimately, the valuation cycle will once again turn around. So does valuations still matter to you? And how does that inform your approach to selecting managers?

That's really an interesting one, JB .. coming from Dan Kemp, mine is really one of looking at the different investment styles and then blending them all together for optimal results for my clients. That's that's basically what I do. So do I believe that value is dead? No... Do I believe that value is about to stage a huge comeback? Not at all.

Gandy 3:49

Bear in mind that for long term investors we're not investing for for the next quarter of the year, now we invest in for the next quarter of the century. So we have got enough time to really allow value to come back. If it is, if it's coming back. If it's not, again, we will see it's just gonna be a matter of time. So we don't aim to be investing in any one particular 'style' is traffic or disinvesting out of it at its peak. No, we we allow ourselves time to watch this space. And only when we are convinced, we then change our positions, either in terms of allocating a little bit more to that one particular style as it as it emerges out of the trough, or to trim down from that particular style once we feel that it's coming down, off its peak period. So what we're seeing now is that you know, the market can actually be separated into two distinct markets, there is the 'old economy', which is obviously heavily dominated by value stocks, then we have got the 'new economy' which is obviously dominated by your growth stocks, and I think we have seen quite a significant shift in terms of human behaviour to the point where one cannot just look at what happened back in 2000, with the .com bubble, and think that it's gonna have a replay Yeah, absolutely not.

JB Beckett 5:10

Yeah, that's a great point about, I think, the old and the new economy. And I think it's gonna be interesting when we start to see those bigger more mature tech companies get through I think that initial phase of growth,

Let me move on to the the second question, and this was the episode number two with Mark Paulson from LangCat. These concepts of value and ESG? And where do you see the value of asset management today, and tomorrow?

Gandy 5:37

That's really another interesting one, JB. And in terms of where we, we see the role of asset management, I think, let me start from that. So Asset Management remains a critical player, in as far as the allocation of resources is concerned, in any economy and in any environment. And obviously, that's driven by the extent also needs to be speaking directly to what the needs of that economy and environment are. So by that alone, you'll find that by virtue of obviously different societies and different economies, live in different needs, what constitutes the right composition of 'ESG consciousness' in one environment tend to differ from..from another, in as much as of course there is there is like a global kind of understanding of what ESG consciousness should, should look like. I think when one then digs down into the different elements of the ESG, the E on its own, the S on its own and the G on its own, digging deeper into the nuances of those three, you'll find that maybe the one element of ESG, where there is kind of universal convergence, in terms of what really is this particular notion all about will be the G of the three, you know, matters around governance, those are.. quite universally kind of acceptable principles across across the globe. The nuances boil down to each individual, economic, individual country, all the way down to each individual investor, based on the lens through which they see the E, the S and the G. But globally, you know, they are some very clear standards by which by which obviously we all aspire to, to subscribe to the principles of ESG consciousness.

JB Beckett 7:46

As fund selectors. We're naturally curious. We are naturally cynical, we are naturally analytical. And I think what I'm seeing now is this move from this kind of Kumbaya trainin which is, you know, is heavily driven by the political narrative, and, and well intentioned, is too, but we're moving into No, the practical steps or how do we actually make progress? That for me, feels like the tonic that cures I think the accusations or greenwash that we're seeing in fund management right now.

Let me move you on to episode three and this is with our mutual good friend Chetan Modi, Gandy is cost due diligence essential to fund selection today? Our emerging managers and boutiques are at a disadvantage to supertankers? Does our industry, frankly underestimate big tech?

Gandy 8:35

I remember listening to Chet on that one JB, and I found his views quite, quite intriguing, and they were quite profound. But that this would be my take. Isn't it rather surprising and a bit shocking, that for an industry that was built on the basis of trust, that we are here today talking about issues like cost transparency, which obviously is also quite closely related to issues around trust worthiness, issues around truthfulness, I just find it mind boggling at times, that for an industry that is supposed to be led by trust, led by truthfulness, led by transparency, we find ourselves having to, to even interrogate ourselves and introspect and asking ourselves whether or not we are being truthful enough whether or not we are being transparent enough, we really need we still have got a long way to go as an industry in as far as cost transparency is concerned.

For instance, lately we have seen the introduction of what our so called 'zero fee' solutions, we know very well that that it is never a zero fee product or a zero fee investment solution, it doesn't really mean that it's not costing the investor anything, it is costing you something and in some instances it's quite a lot this, this zero fee solutions actually becoming very popular, extremely popular in some instances overnight. And that's worrying because the more popular they become, the more of them we are going to have.

I must obviously, once again declare my interests. I am a strong fan and advocate of boutique fund management. So from where I am sitting, having qualified, obviously, my interest, I certainly do not think that boutique fund managers are at a disadvantage, or they need to do is really just to sit back and understand what their core offering is. And then they focus on that the rest, they just need to outsauce. And when you look at the value chain of investment management, you quickly realise that the argument for economies of scale only applies to certain functionalities of investment management value chain, but certainly not to just stockpicking, for instance,

So those functionalities are those functions of investment management value chain that benefit from economies of scale I really strongly recommend boutique fund managers to outsource all of those. The one big advantage that today's boutique fund manager here is by far better than the boutique fund manager of yesteryear is technology technology has actually become one of the greatest equalisers in any industry, but more so in the investment management industry. And they should just take advantage of that; mass distribution and mass customization has never been as easy as it is today. and boutique fund managers should absolutely take advantage of that. And further to that also bear in mind that some of these large, long established managers have got some legacy systems software platforms to really worry about because it's just giving them the headaches in terms of migrating to more more recent and much cheaper and more cost effective platforms. So not at all boutique fund managers are not at a disadvantage. If anything. I think they actually are at an advantage.

JB Beckett 12:17

It's fascinating, I think that boutiques have for quite some time, been on the backfoot because they've been squeezed either by the supertanker asset managers. And then at the other side, as you see you had this ETF wave.

So in Episode Four, we we really did go left field and we saw the discussion turn existential Gandy and I was talking with, of course, Jerome Tagger from Preventable Surprises. Do you think fund selectors underestimate existential risk? And I suppose from that, what are the main risks that worry you?

Gandy 12:50

The question I wanted to, to address together with this is around the threat of big tech, and whether or not you know, the industry should should really be that worried? I know, this might sound a bit a bit controversial. But it is it is my honest view. I do not think that really at this time the threat is there.. But and maybe it's more a perception of the existence of the.. threat, either don't think that it is a real threat. And I will tell you why.

In as much as the capability is there from the big tech to actually just come and capture the investment management industry, come and invade the investment management industry. I think for a number of reasons, we are not going to see that happening anytime soon. The one is at this point in time, especially around now. I think there are more problems within the tech big tech home ground for them to worry about and keeping them busy. The second one is Investment Management on its own. Also, it's got issues around regulation. So not only will they need to do their own regulation within the Big Tech spaceess, they also need to acquaint themselves with the onerous regulations within the investment management industry. That will be the second reason why further delay any kind of invasion into the investment management space. The third one will be around the issue of revenues. In my view, there is a lot more money to be made in the big tech space than there is now to be made in the investment management industry.

So ROBO advice when it first arrived in town and the reception was not as great as it had been predicted but one could make the statement that maybe the market wasn't ready for ROBO advice then; on its rebound now in the era of Bitcoin, in the era of Zoom, in the era of synthetic mid for instance ROBO advice does not sound as strange and exotic anymore and it's going to be dependant on the ability of the fund selection community to actually stay ahead of the curve in terms of providing real tangible value to investors.

JB Beckett 14:24

You know how much I preoccupy my mind with the the existential and I guess the threat of technology and I think it's going to come in a variety of different ways and I think the that idea it was the only threat my guess was going to be 'robo advice' I think you're right and I think it was to some degree was is outdated.

I'm gonna take you into a slightly more contentious space Gandy, in episode five we had our good friend Bella from Fundscape does there need to be a better fund governance have fun gatekeepers and what are the lessons of star manager bias, blow-ups and of course again those supertankers

Gandy 15:46

The question 'who is going to police the police officers?' JB doesn't it?

Any other additional layer of oversight function would come at a cost and that cost ultimately will be from the accounts of investors and at this point in time.. i don't think the industry needs to be adding another layer of of costs to investors. The fund selection the gatekeepers community needs to introspect. There are particular areas where when one looks at the gatekeeping community you kind of feel like there is room for improvement, when gatekeepers go out there one of the demands that they make to fund managers is around issues on diversity but when one looks at their own makeup of the the teams that are demanding diversity from fund managers you actually find them wanting at times that that's the one.

The other one is on on the environment obviously there is there is a push coming through from gatekeepers to fund managers that they should they should be responsible process when they when they're voting for/against resolutions that the investee companies are passing in as far as their effect to the environment is concerned but also prior to COVID-19 and the lockdowns one more they've just did not look very far in terms of where gatekeepers tend with regards to that just by virtue of looking at the number of global trips polluting the environment that can keep us with so much is true. Of course with coming off the pandemic and and the instrument club dance we have seen a pause of that one hopes that when we got back to the new norm that that kind of new norm is going to see by far fewer international trips, even local trips, from gatekeepers as they go out to research to research different different fund managers.

JB Beckett 17:46

So yeah so this has been a reoccurring theme I think of professionalism, or at times you know when it's it's a little bit lacking, I think that we're just gonna keep coming back to this and it's obviously it's one of the reasons that you and I have campaigned for so many years for greater professionalism in fund gatekeeping,

Just a few weeks ago I interviewed Hugues from Fitz partners and unfortunately i'm going to drag you back into the into the cost debates Gandy but we discussed the importance of the 'UCITS' brand of funds and I guess fund governance generally in Europe. How do you think that stacks up against other markets what can they learn from Europe but also perhaps what can they do better?

Gandy 18:28

What we have been observing from Europe is really this accelerated introduction of new pieces of legislation, new new ways of doing things and new practices being demanded of either by; the industry itself or by the regulatory authorities and from a distance I can just say to you that as an industry ourselves we obviously look up to Europe and I'm sure it will be the same for many other markets as well, we here South Africa lagging behind, we are nowhere near where the European market is but we are catching up you know we were not sitting on our list doing absolutely nothing in terms of what legislation is gonna be enough I don't think that is ever going to be a one word answer for that, too much of it is just as bad as too little of it and.. let's let the industry together need to converge it is balancing balancing that thin line that balances the two. I think maybe there is to.. some room to for more lessons especially for as long as the industry and the industry players are failing to to do their parts, surely we shouldn't be surprised that there will be more and more pieces and provisions of legislation being being.. passed on the industry but I think the onus is upon industry players themselves

JB Beckett 20:02

I know we're covering a heck of a lot of different themes here. You know, everything from you know, I see the the role of gatekeepers to ESG to Woodford, which itself is a fascinating thing and I've got David Ricketts coming on to the show later in the season to talk about his book when the fund stops.

Look that just leaves our seventh samurai. And it's one we know very well. And that's, of course Mussie Kidane. And, and we discussed in the last episode, how the industry had changed and his reflections on that. We talked about the new generation of fund buyers coming through. They're not having that first hand experience I guess of the great financial crisis, and how that perhaps changes their perceptions of risk. They also said the role of the fund selector may change in future as a result of technology. You know, when we gather all these different topics together in the seven episodes, how important is professionalism to that future? And of course, how does that link in with your work at the Association of Professional fund investors?

Gandy 21:07

What I find rather quite puzzling is that it wasn't until 2011, that the the community of fund allocators actually decided to come together and say, 'Look, we need to professionalise' or at least we need to get to a point where we are recognised as fund allocators within the financial or the investment management value chain. So professionalism remains very much key, it has always been key. And technology is going to play a very critical role in terms of what value is that professional fund allocators are going to be able to bring to the table. Because this is obviously something that we're quite focused on it at the Association of Professional Fund Investors, it is really around training, especially the new fund selectors. In terms of what it is really, it means to be fund selector of the 21st century for instance. So there is really a lot of work to be done in that regard. But also to just share experiences. And and and come up with ideas from across the globe, in terms of what the best practices of fund selection and fund allocation should be as we as we go forward. So that's that's the role that the Association plays. And that's the one that you do need to continue to play to bring better value to investors at the most cost effective ways possible.

JB Beckett 22:35

Thanks, Gandy, yes, and I'll drop a link to the Association of Professional Fund Investors in the podcast show. So that fund selectors that are tuning in, they can find their way to the APFI, and find out how to join.

Look, Gandy. That's our Seven Samurai. I'm really, really happy that you've kind of come on the show to help me review the first seven episodes of the show. And um, I'm very glad for you to be our eighth samurai, to you know, to cover all these issues, but before I let you go, I do have to I'm afraid to ask you this quick rapid fire round of 10 questions.

And if you are ready, question number one, bull or bear

Gandy 23:20

Bull

JB Beckett 23:23

Question number two Bogle or Buffett, Buffett.

Question number three, profit or planet?

Gandy 23:31

Planet, of course.

JB Beckett 23:32

Now we're cooking on gas, Question four, divest or engage?

Gandy 23:36

Engage.

JB Beckett 23:38

Question number five, lower cost or better value?

Gandy 23:42

Well, that's an interesting one. better value.

JB Beckett 23:48

Question number six, perhaps even more interesting one but suspect I know how you're going to answer supertankers or boutiques?

Gandy 23:55

What takes squared? If that is an option? Yeah, it's but it's boutiques and more boutiques.

JB Beckett 24:05

Question seven, star managers or team players?

Team players JB.

Question eight, public or private?

Gandy 24:14

Is there an option like a good combination of both?

JB Beckett 24:17

Nope, there really isn't.

Gandy 24:20

Okay, public

JB Beckett 24:22

Question nine, high growth or stable income?

Gandy 24:26

Stable income

JB Beckett 24:27

And question 10 the one that everyone loves.. to hate, socialism or free markets?

Gandy 24:35

in 2021, it can only be free markets.

JB Beckett 24:39

And next is the the bonus question. If I can ask you to pick a number between 11 and 40

Gandy 24:46

Between 11 and 40. That would be number 27.

JB Beckett 24:53

Question 27, religion or humanism?

Gandy 24:59

That's it. Difficult one eh. I'll go with religion

JB Beckett 25:03

So that marks the end of our interview Gandy you have survived the new fund order, you have reviewed with me the Seven Samurai have fund selection, I just want to say thanks very much for coming on the show. It's been been great fun.

Gandy 25:18

Thanks, JB It was really a pleasure. Being in the show and being your guest. I really look forward to more invitations like this one. And also even more importantly to look forward to more episodes with the rest of your other guests that you have lined up.

JB Beckett 25:32

Please don't forget to like and share and subscribe you know, click the subscribe button a new podcast every two weeks with a new guest. Stay tuned.

A big thanks to you, dear listener for tuning in. Brought to you by my sponsor, Allianz Global Investors. and a warm thanks to today's guest, weekly, I am compelled to remind everyone that all views of this podcast are of course independent and do not belong to any affiliation or organisation. Just in case that was in any doubt.

Tune in for the next podcast every two weeks from.. the new fund order. Please subscribe, share, like and comment. Let me know what you think and what you'd like covered in future episodes. Until then, stay safe and keep it left field.

Clip from Seven Samurai (1954) 26:21

-------

Transcribed by https://otter.ai