The New Fund Order

Deep from inside the City's shadows... author, speaker, NED and ex investment gatekeeper Jon 'JB' Beckett explores the Industry's taboo and hot topics. Dear Citizens of the People's Republic of Podcast, welcome! The New Fund Order is here; from existential risk to the human condition, a contrarian exploration of the Darkside, the Frontier and the Fringe of; Asset Management, Finance, Fintech, Mutual Funds and Macro. Bringing you news, views and interviews. Like a philosophy-economics mash up with science fiction, B-movies, Kung Fu films, cold war spy films, to Spaghetti Westerns... all delivered from the left-field with an Orwellian chill.. #newfundorder ALL VIEWS ARE INDEPENDENT. PLEASE check out my book website: https://www.blurb.co.uk/b/7337318-newfundorder-2-0 and Youtube channel https://www.youtube.com/channel/UClzN8gpccuVtdfW47TM_pPQ Season 2 ‘Fight Club’ is here ...

The New Fund Order

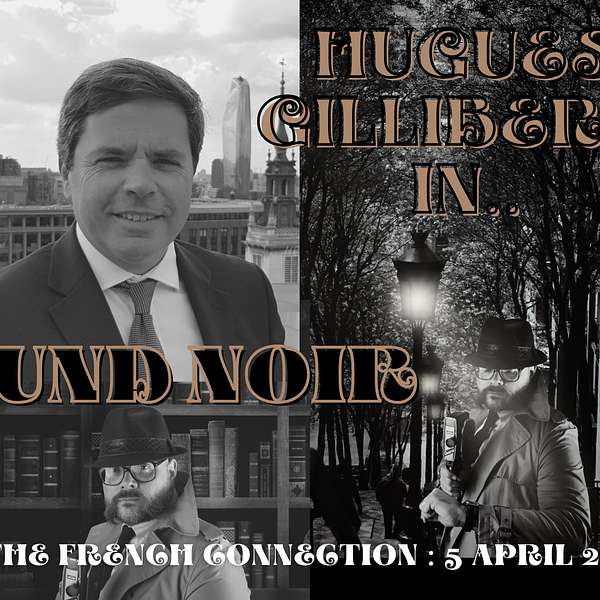

Fund Noir: The French Connection Dossier (on Distribution)

Welcome to the New Fund Order. An Orwellian journey into the Darkside, the Frontier and the Fringe of Finance.

A cold wind is blowing.. As night falls on Europe, in the City a bearded stranger checks his watch under street lamp, beneath his trilby and overtly 60s square glasses he checks the time. As he waits he grasps onto his Russian 8mm cine, in the shadows lurk all the secrets of the European fund distribution industry. His contact, a Frenchman, has the dossier he needs but will he talk?

Join us in the noir of fund costs and governance, just how well do fund selectors understand the costs of the funds they are paying for and does the industry offer good value?

Many things change yet some things remain the same. Our industry is nearly 8 times larger than 2 decades ago but does it offer investors eight times the experience? Our contact is Hugues Gillibert, co-founder of Fitz Partners, our de facto 'man on the inside' and keeper of the industry secrets. We go all espionage with Hugues to discuss value for money.

Together with left-field opinion, global market news and latest views, direct from my dystopian bunker. In the Air, on the Ground, on the Street and around the corner of Debate. Watching, listening, in the Shadows and on your Airwaves. For Fund Selectors, distributors, wealth managers and investors.

In association with my sponsor Allianz Global Investors (AGI) one of the world's leading active managers. My thanks to my guest Hugues and Fitz Partners.. and you dear listener.

Please LIKE, SHARE and SUBSCRIBE. Please leave a REVIEW and let me know what you think and what topics you would like for future episodes. Until then... stay safe and.. keep it left-field!!

That's 20 episodes, 20 Guests, every 2 weeks... each episode is 25 minutes!

Join the NFO Army Citizen, https://www.patreon.com/newfundorder

Left-field Finance.

#newfundorder

Credits;

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Archive.org. JFK Inauguration speech (1961). Public domain. First released 1991.

Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0.

All additional Music used by Silvermansound.com Attribution 4.0 International (CC BY 4.0)

Allianz Global Investors (AGI)

Active is: Allianz Global Investors.

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

Computer 0:00

Episode 006

Clip: JFK (1961 speech) 0:03

The world is very different now.

For man holds in his mortal hand..the power to abolish all forms of human poverty and all forms of human life ..

JB Beckett 0:18

Salutations Dear citizens as we peer into the new fund order to discover the immutable truth for asset management and wealth managers,

The lowdown from the dark side the frontier on the fringe of asset management and fund research,

Clip: JFK (1961 speech) 0:34

United there is little we cannot do, in a host of cooperative ventures. Divided there is little we CAN do.. for we dare not meet a powerful challenge at odds, and split asunder.

JB Beckett 0:51

A podcast for wealth managers fund selectors, distributors and investors. Bringing to you the People's Republic Podcast of Finance, in association with my sponsor Allianz Global Investors, capturing the latest market news, views and interviews with leading minds in our industry.

Allianz global investors is one of the world's leading active managers.

Our guest today is Hugues Gillibert, Director of Fitz Partners Limited and he has been leading up Fitzrovia since the 90s. Where he was director and head of research of Fitzrovia international and then before it became Lipper Fitzrovia before again spinning back out to become Fitz Partners Limited. Under Hugues' leadership as director of Fitzrovia International Hugues' data team made over 350,000 total expense ratio calculations based on a consistent methodology, covering over 55,000 funds worldwide. He has supported a number of working groups on fund expenses for both INREV and ALFI. Hugues is therefore an authority when it comes to discussing fund costs, cost transparency, value assessments and indeed the direction of European fund governance.

Computer 2:09

Market news

JB Beckett 2:10

And in market news.. money week runs with 'vaccine wars will harm us all' grabbing and hoarding vaccines, supplies or even manufacturing ones own might seem to make sense for a state in an emergency but the damage done to trust and prosperity will be huge. Simon Wilson reports the spectre of "vaccine nationalism" is still haunting Europe falling Ursula Van Der Leyen's threat last week of emergency EU controls on vaccine production and distribution to meet the 'crisis of the century' even perhaps activating article 122 of the EU treaty which authorises emergency measures.

Money week also runs with a "bet on the future of technology" graphics chip specialist NVidia will profit from big trends ranging from artificial intelligence to robotics. News that the world is struggling with a major microchip shortage and these sharp divergences from different microchip stocks are creating opportunities. He among them is graphics chip specialist Nvidia NASDAQ $NVDA. Moneyweek also noted they troublesome Deliveroo IPO "which could cause indigestion", takeaway delivery platform Deliveroo is set to be the biggest London Stock Market debut since Glencore almost a decade ago, says Mark Sweeney and Sienna Butler and the Guardian. Having priced the value of the company at up to £8.8 billion, about £1 billion more than initially expected. And of course, we've seen subsequent volatility on the share price. And the Guardian notes that as a firm that had "wolfed down £1.3 billion of private capital" since 2013; without any sign of turning a profit not even during the lockdown take away boom, was it worth investing in conclusion, it might "not seem so appetising".

And lastly, for money week, "The Empire Strikes Back", established industry giants are taking the fight to tech startups. In doing so they will have "second mover advantage". Second movers have two big strengths they can learn from the pioneer and not repeat its mistakes and can imitate what it gets right. The stock market has assumed for a long time that this tech startups will always win. Sometimes, though, all the pioneers do is demonstrate new business models with some of the old giants then perfect.

National Geographic runs with a curious story about a "line in the mountains" or us agencies tiny change to a map pushed Indian and Pakistan to the fight on the world's highest battlefield. Who made the change has remained a mystery until now. And indeed it was head of the US office of the Geographer Robert Hodgson had laid out his guidance for how to show the 1948 ceasefire laying on all official us maps he created a straight line traversing snow clad mountains and high desert in the north easterly direction to link NJ9842 to the Karakoram pass, an ancient Silk Road byway on the Chinese border. "Did these people die because of a geographers mistake?" asks Freddie Wilkinson. "Hodgson's line definitely played a role in leading to the war". It didn't result in a war but it was most decidedly a factor.

Meanwhile, Bloomberg's Nishan Kumar writes that Brevin Howard has created a $50 billion unit like Blackrock's Aladdin to challenge US dominance in the third party portfolio systems market.

Andrew Beer, founder and managing member of Dynamic Beta Investments in 'ETF Strategy' writes that "hedge fund factor replication copies how leading hedge funds are invested cheaply and simply", he proposes that offers a way to lower fees in the hedge fund space and investors will of course recall the variable returns of the HFRX indices and risk premia ETFs, which Beer argues can be avoided.

'Portfolio Advisor' notes analysis by Fund Calibre, found the average ongoing charges figure (OCF) for actively managed equity funds has fallen from 1.13% in 2017 to 0.95% this year, using data from FEfund Info. It also found that the average annual cost of a newly launched equity fund has dipped to 0.85%. And lastly, "SFDR Basecamp. reached now comes the hard part" writes Adrian Wheelan for BBH. The first phase of the EU sustainable financial disclosure regulation or SFDR, focused on adherence to the EU's ESG agenda representing the industry's arrival at "base camp". Adrianb then outlines the three remaining challenges, as the focus now turns to the detailed.

And that's the end of the market news tag #newfundorder and let me know what stories you want to hear about.

Computer 6:17

Interview (echoes)

JB Beckett 6:19

And in these strange pandemic lockdown times, rest assured that all guests are calling in remotely.

And welcome to the new fund order podcast Hugues it's really nice to catch up with you. And, you know, between you and I, you know, I want to talk about all those dark secrets of the European fund industry. Nice to have you aboard.

Hugues 6:42

Thank you, JB, it's nice to be here on this fine Friday afternoon.

JB Beckett 6:48

And, you know, you have been pretty much for most of my career as a fund analyst, you know, at the forefront of cost analysis in European fund industry. And, you know, so I'm not I'm not going to start talking about how old you and I are getting right, we just we can forget about that. But we both have, I guess the the benefit of perspective, you know, through the 1990s and the 2000s. And I guess my first question to you is, did Asset Management pay much attention to cost back then? And if they did, how does that differ with today?

Hugues 7:23

Ahh that's a great question JB. As you say, we've been we've been, we've been going for a while..

And it's Yeah, so things have changed. Now, when you say cost, the first thing to think about is like 'do you mean their cost, or your cost as an investor?'. So because I guess, you know, the, the view might be slightly different. So well back in the 90s… put this into perspective, actually. So 1996/1995, we were the first one to actually calculate total expense ratios in Europe, there was none at all. I mean, no one actually knew they were other costs than the management fee, if they knew there was a management fee paid actually out of funds.

So then, and even within the industry, as in asset managers, we're not actually really, you know, take so much notice about those costs, because I think, you know, you had a fund, you just put a number on the, you know, the, how much you should get for running that fund, whether it's was 1% 1.5% 2% 3%, you know, depending on who you were, and what you were managing. And, and, and investors were just buying into this, because there was no comparison at all, and so, so it was very kind of opaque. And then, and then obviously, so, we started calculating those sort of expense ratios, and they became public. Now I can't, I can't quote, you know, online here, you know, what kind of names we were called at the time, because I was always showing some numbers that were not very, very, very good for asset managers.

But, but to be fair, the, it's very much a, it was a gradual change, so I would say probably towards the year 2000…

We were talking about having a, you know, a new prospectus, a simplified prospectus, and then the KIID documents, and then transparency actually came in. And then you had, we were licencing all these total expense ratios to to some platforms or some some data providers at the time. And then so because he became more public and then and then suddenly, you have to take notice, I mean, you can't, you can't just carry on and and do you know, whatever you think is probably best for, you know, for your margins, but certainly you need to probably think about you know, what, you know what, what makes sense and, and and how you compete against the other so, so that's that's that has changed and and I will say now..

The transparency is there as in as in maybe not, you know, within the costs themselves as in people don't really need to probably know, you know, what, what kind of admin fees they've been charged on that funds. Unless you're unless you're maybe in an institutional investor, or if you really want to know, but if you're in a bit of a gig, but I mean, if But definitely, you know, you want you want to compare your funds against against the others. And, and those total expense ratios, or what we call now the ongoing charges.

Those those actually help investors, and they've been wildly available. And so yes, absolutely. Now they need to actually pay attention. It is way more focused now. And, and, and I must say it was a great sale for us. I mean, we were just always looking at what was in charges, because obviously we're the only one looking at these. So it's but it's it's I think it's probably more now in the open. It's not everywhere, but it's more it's more than then I think, you know, there's more, there's definitely a, much you know degree of a better degree of focus on on those on those fund costs. Absolutely.

JB Beckett 11:06

What do you think what what's your take on the different moves that you're seeing, towards better fund governance, towards value be it the the assessment of value we're seeing here in the UK? The cp86 moves in Ireland? or indeed some of the changes to Lux funds? Do you generally view those changes as helpful? Or do you view some of those changes? as potential hyperbole?

Hugues 11:29

Oh c'mon they have to be useful. Yeah. I mean, they have I mean, I think, you know, I think it's okay, some people are never happy, or there's never enough, but I mean, to be fair, the, in the UK, so okay, first maybe maybe wants to bag. I mean, a lot of us measures were doing something similar. They were doing it internally, you know, we've been, we've been working with a lot of product teams within asset management. And those teams were actually running, you know, similar kind of benchmarks, you know, maybe not on a yearly basis, but at least every 18 months or two years. But it was not like structure as such, and, and really the value assessment, or what's what's happening, you know, in other jurisdiction, it's, it's, it's helping is definitely helping,

I wrote a couple of pieces in the, in the Luxembourg, price about, about governance, and, and at the time, there was a lot of calls about, you know, people were not at after 2008 people get confused about bankers and asset managers and, and about, you know, the trusting the finance, environment, as it were, and, and, you know, and and one of these couple of speeches abroad were about, you know, 'governance' and, and trying to try to publicise what those people were doing, because the, the issue is, you know, you might do it on the ground, if you want, you know, you look internally, but you're not actually publishing it, and the problem is not not so much publishing it, but making it public as in, you know, telling people you're doing this, and I'm gonna say, some of the boards, especially in Europe, I think they could have, they could have maybe pushed something a bit more, you know, the push for these reporting. It's and the changes, I mean, we we saw in Dublin, that the changes in the performance fees, for example, okay, so all these, all these changes have happened. They've been they've been pushed by, you know, better governance, slightly, you know, pushed as well by, by by regulations. But the thing is, I think at the end, it's, it's, you know, it's, I would say, after all these years, it was 20 odd years that we've been doing this, this, this this work, and looking at this, this industry, I think, you know, it's it's a much better place, it's much cleaner, as in, you know, you don't have some some, you know, some some some very exotic fee structure somewhere. Yeah, I think it's a, you know, it's, it's, it's leaner, as well, and, yeah, it's for the better, I think, I think it's, I think it's been working, it's been working very well, actually,

JB Beckett 14:03

What is the future of the UCITS brand of, I guess, cross border fund, you know, and a very, a very polite quiet, I guess, competition between pushing local level funds, versus perhaps the, you know, the traditional, you know, cross border centres of Lux. And, you know, Ireland.

Hugues 14:22

Yeah, it's sort of like competition, right. So, I mean, it's, it's, again, it's this, this, your, your, your, your main, you know, your main question is on UCITS, it's, I think, okay,UCITS is a very strong brand. I mean, it's definitely a strong brand, it's not just a strong brand in Europe, it's strong brand, you know, across across Asia as well. A lot of countries actually love this, this this product, so it's been tested, it went through a few cycles, bad ones. I think, you know, I think it's his got he's got this you know, it's got this kind of past and track record if you want. So, you know, I think it's it's very competitive. Now what, you know, what other products can do to use it? You were talking about a polite and gentle competition, I think, you know, I think either you have competition full on, or you you're trying to avoid it and it would be dangerous maybe for the smaller players or the mid range players if you want if you have if you have a full on capital competition between, you know, between, you know, between those different type of products? I mean, it would be, it would be very costly I would think.

JB Beckett 15:39

Yeah. And it's all about choice, right, it's choice for fund distributors, you know, where do they set up their jurisdiction and you know, I'm not here to, you know, to set fire to that one, perhaps maybe I'm just a little bit but the, the, you know, the Irish fund industry will say, you know, come to Ireland, it's the best for fund governance, they've got the, the pre FACTA compliance through their ICAV structure, and they've got the UCITS compliance, ALFI will clearly say, the best place to come is Luxembourg, they have the longest perhaps track record, they have a very strong regulator, in their view, in the CSSF. And of course, the UK will, despite I guess, some of its woes of more recent times say that, you know, the UK is the most regulated, they are probably all wrong to some extent. But, you know, do you see it is difficult for both the fund selectors and I guess it goes also for fund distributors.

Hugues 16:39

I think it's a good poin but I think, to me, I always go back to, who is going to be buying those funds. Okay, so so the investors I mean, do they actually really care whether that fund is domiciled in the UK, Luxembourg or Dublin?

JB Beckett 16:55

I think you would agree with that. Let's say, um, that was the easy question out of the way, let's deal with a slightly more thorny issue Hugues, and I think that's one obviously, of the pricing of active funds, and where do you see it going from here?

Hugues 17:10

Okay, So here, I'm going to detach slightly myself from from all the data we have, okay, because we obviously, the data is very helpful to know where we come from, and we come from a higher point, and we are now, that's for sure. Now, it's, it's not always as clear cut as this. So so as you know, as obvious so this is definitely the trend. And I think that trend will probably continue a bit. It's as much as you know, there were there were okay, there were there wouldn't have been a massive wave of, of demand for passive products, what what I think is interesting is, is really the trend, as much as it was the passive funds or the passive space actually pushing the cost down, I think now you have a few asset managers, active asset managers actually, almost leading that charge as in, you know, they are they are almost anticipating the next drop if you want. And, and, and, and that's and that created another another wave of of reduction into in in fees. So that's, that's, that's probably, you know, and, and I think he would carry on, until we've reached a point where people we say, 'right, okay, so now we've, we've, we've done as much as we could, okay', so, we managed to, you know, we manage our shareholders expectations, because obviously, we you know, the margins have gone down, and, you know, and this is this is getting, this is getting tougher to actually, you know, get get to be to be to, to, to, to run those, those asset management firms.

And, and then, and then we will come to the point where we say, 'okay, we're, no, we're not now, probably, we're not going to lower the fees anymore'. Because we reached that point where, you know, the platform's are happy, everybody's happy that we, you know, we got to the right point, but for all these products, who are maybe not that good, then we need to make to take action. So and I think what would probably happen is, at some point, we're going to reach this, we're gonna plateau, I mean, that that those those those costs will probably plateau. And, and then we're gonna see is like, if, if that product is not actually viable, then then it has to go. And that's, that's, you know, and this is something that we you know, that's this is something for the for the product teams to actually decide for maybe from some boards, but I think it's it's very much the the way that we I see it. I think there's still going to be the same scope for, for for lowering down the fees. But, but I think at some point, we're going to, we're going to reach this point where now we need to not to talk about the fees anymore, but talk about the products and seeing whether that product actually makes sense or not at that fee level. If you know, if not, then in that case, you know, we something needs to needs to happen.

JB Beckett 19:56

But then when we've sort of think that through to its logical conclusion, Hugues in terms of 'At what point do fund selectors should they expect fund managers to give up their investment fee' to start to compress that down? That but also, you know, is the just the logical journey of all this going to be for all funds to commute across to exchange traded funds?

Hugues 20:18

Okay, so yeah, two parts. So investments, investment advisory. Investment advisory fees, it's actually very interesting. So we have, we do look at investment advisory fees. So as you know, this, this is this is like, this is, this is one of these part of fees that stay very opaque actually. So it's, it's, it's paid out of the management fee. But you know, no one knows really, you know, unless, you're, you're in that fund, no one knows exactly, you know, how much how much of the management fees actually paid for investment advisory. And what we've seen, actually, in the, in the, when we compare the level of management fees, I was going back to what I was discussing before about the, the fees going down. So when we compare those those management fees, so we've seen the management fees going down, you know, for now, for quite a number of years. But when we were looking at the investment advisory fees within those management fees, they were not moving until probably last year or two years ago. So suddenly, those fees have actually gone down.

So what does it mean? It means, I think, to me means two things. One is, you know, you, you can't you can't carry on, you know, charging or lowering your management fee, and then the block in the middle that's paid for portfolio management is actually not moving, you need to you need to actually, you know, you're, you're under pressure to get your fees down. So so you need to actually move the component of those fees down as well.

Now, on your on your questions on ETFs I think this is a very this is, this is extremely interesting, because it's okay, this is one of those things where I think you just mentioned actually being able to have a chat about having choice. Yeah, it's about choice. So yeah, absolutely. It's about choice. And I think, you know, we see this there's some asset managers now, in Europe, they have, and very large one. I mean, there's, you know, they do, they do have ETFs share classes. So an ETF is not the problem with the industry or with the you know, with the way actually some some sometimes we you know we picture ETFs it's it's a passive cheap product, but actually ETF is not a product, ETF is a ETF is a conduit to a portfolio and and to an investment so, so whether you're going through the funds or you're going through an ETF to get to that portfolio and to and to get your returns it's it should be the it should be the choice of the investors and I think you know, and I think you know, the asset managers are actually now creating you know, long sheets new phones and they have they have a retail Class A clean class and Institutional class and then they have an ETF class, and then why not actually because you're you know you're you're opening your you know, you're opening the choice to to investors and to the distributors as well.

JB Beckett 22:58

All that leaves now is my favourite part of the interview, which of course is the is the rapid fire round and this is 10 very, very easy questions for for guests to answer. It's all about the gut feel no right or wrong answer. If you're ready, we shall begin

Computer 23:16

rapid fire round

Hugues 23:17

Let's have a go.

JB Beckett 23:19

Okay, question number one, bull or bear?

Hugues 23:28

Bull.

JB Beckett 23:30

That's only question number one. Question question. I'm slightly worried. Okay. Question number two, question number two Bogle or Buffett

Hugues 23:44

Come on long term I like I like Buffett.

JB Beckett 23:48

Okay. Question number three, profit or planet?

Hugues 23:56

ahh is very tricky. I think planets and planet and profit, vcan I have both?

JB Beckett 24:00

No, you have to choose one

Hugues 24:03

planet, planet

JB Beckett 24:05

Great stuff. Question number four, divest or engage?

Hugues 24:09

Engage

JB Beckett 24:10

Question number five, lower cost or better value?

Hugues 24:16

Better value

JB Beckett 24:17

Question number six. supertankers or boutiques

Hugues 24:21

Boutique

JB Beckett 24:23

Boutiques. Okay.

Question number seven. Star managers are team players?

Hugues 24:29

Team players.

JB Beckett 24:31

Question number eight, public or private?

Hugues 24:34

Private

JB Beckett 24:35

Question number nine, high growth or stable income?

High Growth

..and Question number 10. socialism or free markets.

Hugues 24:46

I have to say free market

JB Beckett 24:48

..and that just leaves the bonus round and if you can choose a number from Hugues between 11 and 40

Hugues 24:57

25

Question 25 utopian or dystopian?

Dystopian

JB Beckett 25:07

..keeps it nice and dark for this episode.

Hugues 25:11

It's my first podcast.

JB Beckett 25:12

Oh, well, I feel very privileged to have you on your first podcast. It's been fantastic having you on the new fund order Hugues and there's no trophy coming in the post but uh, you know, my my thanks, and congratulations for surviving the new fund order.

Hugues 25:28

That was a pleasure, great stuff, thank you very much. Thank you.

JB Beckett 25:31

Thanks Hugues.

Please don't forget to like and share and subscribe, you know, click the subscribe button, a new podcast every two weeks with a new guest. Stay tuned.

Computer 25:41

JB opinion.

JB Beckett 25:43

So what do we think Dear Citizens when we listen to Hugues and his observations?

There is room for optimism that the cost fees across the European fund market have been compressed, they are coming down. But at the same time, I think there are still a number of areas that have not been fully addressed. And this is perhaps the the biggest challenge facing us as fund selectors going forward. So drop me a message drop me a comment as to what you think how important is cost analysis and the value and the cost of funds that you are investing into? Is it something that preoccupies you or there frankly, bigger threats to worry about?

I think thanks to you, dear listener for tuning in, brought to you by my sponsor, Allianz Global Investors. A warm thanks to today's guest. Legally, I am compelled to remind everyone that all views of this podcast are of course independent, and do not belong to any affiliation or organisation. Just in case that was in any doubt. Tune in for the next podcast every two weeks from the new fund order. Please subscribe, share, like and comment. Let me know what you think and what you'd like covered in future episodes. Until then, stay safe and keep it left field.

Clip: JFK (1961 speech) 27:07

We did not forget today that we are the heirs of that first revolution. Let the word go forth. From this time and place, to friend and foe alike, that the torch has been passed in your hands, my fellow citizens more than mine will rest the final success or failure of our course. The energy, the faith, the devotion, which we bring to this endeavour. Will light our country and all who service it and the glow from that fire can truly light the world.

Transcribed by https://otter.ai