The New Fund Order

Season Finale: Into the Mind with Nuala Walsh

Welcome to the Darkside of Fund Management and Research... the New Fund Order.

Episode 20: Into the Mind

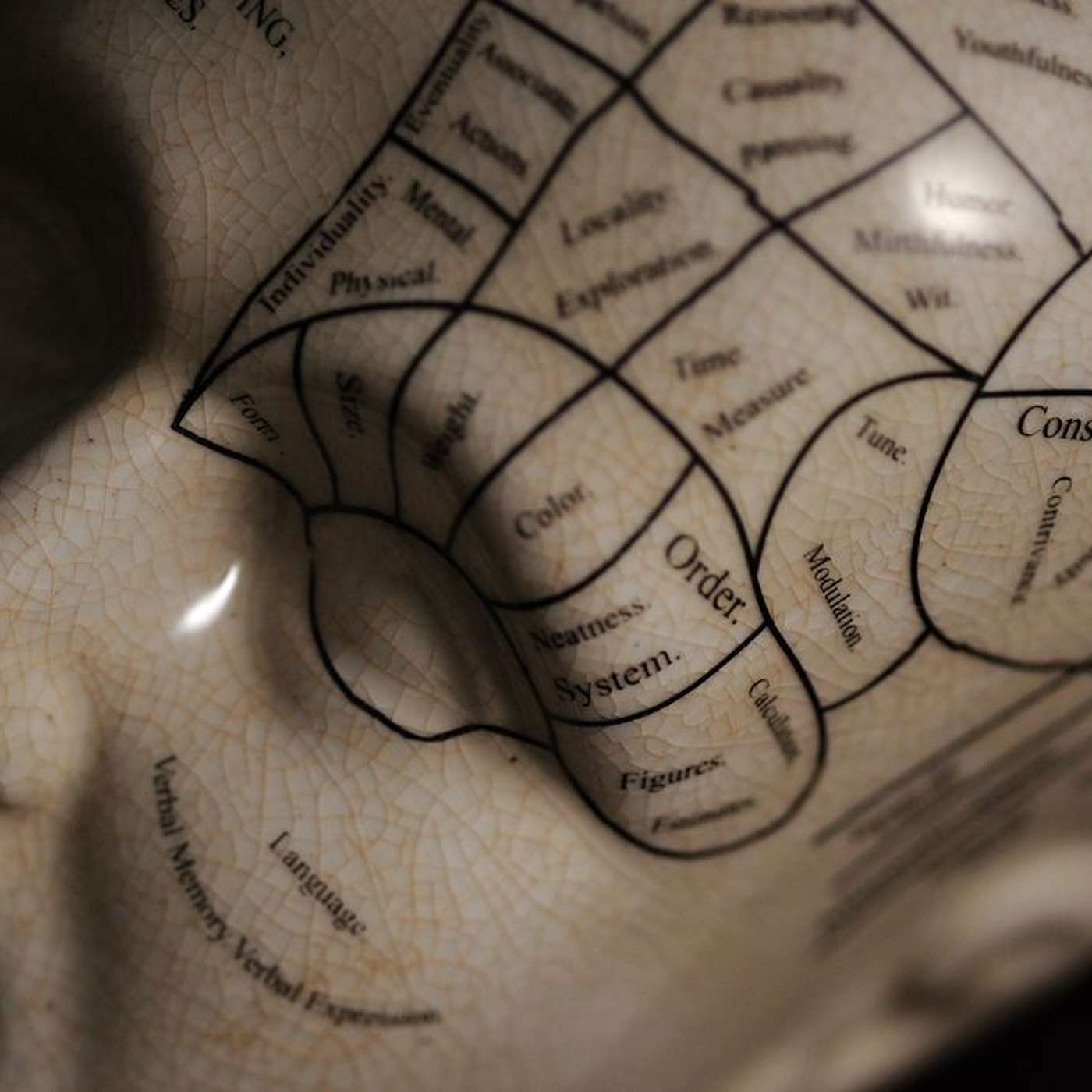

The sky arcs obsidian, as thunderous clouds roll in and heavy rain pours down. We are forced to open an iron door and take refuge inside an old hospital only to be greeted by the wails of its patients within. What dark horrors await us in this place?

Step into our asylum of cognitive discourse to explore the dark corners of the mind of the fund selector. Everything from cognitive bias to heuristics, star mangers, monsters and criminality. We walk down the chilling corridors, with Mind Equity's Nuala Walsh, as we ask the taboo, the frightening and the controversial. This season finale then offers the culmination of a series of behavioural episodes in Season 1. We ask;

Are Monsters and Villains the psychological flip side of star manager culture and ideology?

How can overweighting IQ over EQ hurt outcomes, our desire to be cleverer then the next person?

What does it mean to observe irrationality?

How can understanding the peak-end rule help in decision making?

Should selectors be more like FBI agents when researching fund managers or attending a blow up?

About Nuala: A global strategic adviser, Non-Executive Director, behavioural scientist, and award-winning marketeer, with decades of experience in asset management, investment banking, and consulting.

Founder of MindEquity - a business, brand, and behavioural science consultancy.

Founder and Director of the world's first Global Association of Applied Behavioural Scientists.

Various Board / Advisory Appointments:

- Investments (TSLombard; JD Haspel; Chartered Institute of Securities & Investments);

- Sport (The Football Association; World Athletics);

- Non-profits (UNWomen UK).

Former Chief Marketing Officer at FTSE-50 plc, Standard Life Aberdeen with a track record of growth, modernization, and globalization at Merrill Lynch, Blackrock, and Standard Life Investments. Also led sponsorships in golf, rugby, tennis, motor racing eg. Ryder Cup; British & Irish Lions; Goodwood and ATP Champions Tour.

Named among Top 100 Most Influential Women in Finance; and the 50 Most Innovative CMOs.

Holds a Masters in Behavioural Science; Masters in Business Studies; BA in Philosophy. Studied Forensic Psychology.

Published and cited in various publications - Harvard Business Review, Economist, Telegraph, Fox Business News.

A keynote speaker, coach, and visiting lecturer in multiple universities.

Go to: MindEquity: Overview | LinkedIn

Credits

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Public domain 1.0. Archive.org. Youtube.com. Additional Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0. All additional Music used by Silvermansound.com. Music: The Visitor by Shane Ivers - https://www.silvermansound.com, Attribution 4.0 International (CC BY 4.0)

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

Welcome to the Darkside of Fund Management and Research... the New Fund Order.

Episode 20: Into the Mind

The sky arcs obsidian, as thunderous clouds roll in and heavy rain pours down. We are forced to open an iron door and take refuge inside an old hospital only to be greeted by the wails of its patients within. What dark horrors await us in this place?

Step into our asylum of cognitive discourse to explore the dark corners of the mind of the fund selector. Everything from cognitive bias to heuristics, star mangers, monsters and criminality. We walk down the chilling corridors, with Mind Equity's Nuala Walsh, as we ask the taboo, the frightening and the controversial. This season finale then offers the culmination of a series of behavioural episodes in Season 1. We ask;

Are Monsters and Villains the psychological flip side of star manager culture and ideology?

How can overweighting IQ over EQ hurt outcomes, our desire to be cleverer then the next person?

What does it mean to observe irrationality?

How can understanding the peak-end rule help in decision making?

Should selectors be more like FBI agents when researching fund managers or attending a blow up?

About Nuala: A global strategic adviser, Non-Executive Director, behavioural scientist, and award-winning marketeer, with decades of experience in asset management, investment banking, and consulting.

Founder of MindEquity - a business, brand, and behavioural science consultancy.

Founder and Director of the world's first Global Association of Applied Behavioural Scientists.

Various Board / Advisory Appointments:

- Investments (TSLombard; JD Haspel; Chartered Institute of Securities & Investments);

- Sport (The Football Association; World Athletics);

- Non-profits (UNWomen UK).

Former Chief Marketing Officer at FTSE-50 plc, Standard Life Aberdeen with a track record of growth, modernization, and globalization at Merrill Lynch, Blackrock, and Standard Life Investments. Also led sponsorships in golf, rugby, tennis, motor racing eg. Ryder Cup; British & Irish Lions; Goodwood and ATP Champions Tour.

Named among Top 100 Most Influential Women in Finance; and the 50 Most Innovative CMOs.

Holds a Masters in Behavioural Science; Masters in Business Studies; BA in Philosophy. Studied Forensic Psychology.

Published and cited in various publications - Harvard Business Review, Economist, Telegraph, Fox Business News.

A keynote speaker, coach, and visiting lecturer in multiple universities.

Go to: MindEquity: Overview | LinkedIn

Credits

George Orwell 'Nineteen-Eighty Four', Public Domain 1.0.

Audio clips: Public domain 1.0. Archive.org. Youtube.com. Additional Sound effects by Soundbible.com. Creative Commons Attribution 3.0 and Public Domain 1.0. All additional Music used by Silvermansound.com. Music: The Visitor by Shane Ivers - https://www.silvermansound.com, Attribution 4.0 International (CC BY 4.0)

Active is: Allianz Global Investors.

Disclaimer: This post contains affiliate links. If you make a purchase, I may receive a commission at no extra cost to you.

JB Beckett 0:19

Salutations Dear Citizens as we peer into the new fund order, to discover the immutable truth for asset management and wealth managers, the lowdown from the dark side the frontier on the fringe of asset management fund research.

A podcast for wealth managers, fund selectors, distributors and investors. Bringing to you the People's Republic podcast of finance, in association with my sponsor Allianz Global Investors, capturing the latest market news views and interviews with leading minds in our industry. Allianz Global Investors is one of the world's leading active managers.

... and in these strange pandemic lockdown times, rest assured that all guests are calling in remotely interview.

Hi Nuala, welcome to the new fund order for our season finale.

Nuala Walsh 1:25

Thank you very much JB, I've always wanted to be in a season finale of something. So I'm delighted that it's yours.

JB Beckett 1:31

I'm a bit excited, it's the season finale, it feels like such a journey to get to this point. So I'm a little giddy, but please, please bear with me.

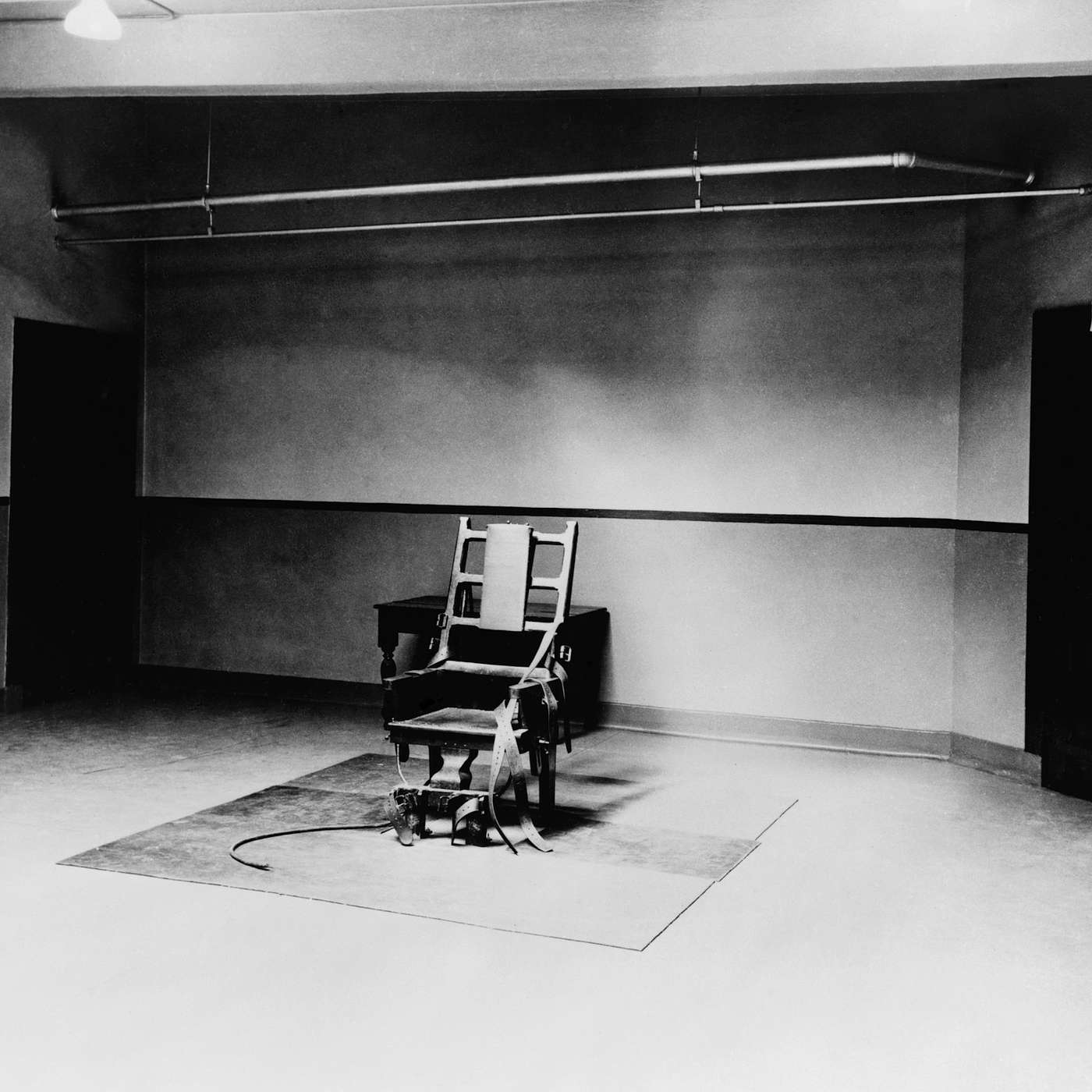

But we are... here we are safe in our very own audio asylum of cognitive discourse, a chance to really explore the mind of the fund manager and indeed the fund selector, from those blind spots and biases, risk taking to perhaps even criminality.

So please take a chair. If you're feeling comfortable, we shall get started.

Nuala Walsh 2:00

Perfect.

JB Beckett 2:01

Now we both share an interest in serial killers. So I thought we'd start on a high a nice, nice, light topic. We both share an interest in serial killers and what were once described as sociopathic and psychopathic tendencies. You have also studied this in detail. My own exploration, is...little more than a passing dalliance. But I was noting the work of Natalie Lawrence at Cambridge, and she was talking about this idea of real world 'monsters', and how they perhaps serve a societal purpose. And then I was thinking, of course, even in our own industry, especially when we first idolise and then later vilify individuals like Neil Woodford. In other words, are monsters, the inevitable psychological flip-side of star managers?

Nuala Walsh 2:46

What a deep question, JB, but it's actually, a great question. And because I've always put together criminality, and celebrity and corporations, so I suppose the first thing that I'd say about that, it's huge. So I look at it in two parts. It's human nature to idolise people, whether it's your musician, footballer, CEO, or even your gifted cousin, should you have one. And I think we find that the smartest people hero worship, whether it's a Fortune 50 CEO, or a Nobel Prize winner admiring another prize winner, so I think it serves a positive purpose in role modelling and obviously, it's very inspirational for others. Neil Woodford in his day certainly would have inspired many young analysts, selector or fund manager, but of course, there's a danger in the halo effect. You set them up for a fall . And sometimes a celebrity opinion on the market often appears to have the stock market validity, so one word from an Elon Musk or even an Oprah Winphrey will rival any Warren Buffett's opinion.

So for me the second stage of this idealisation is of course the tragic fall from grace and the inevitable vilification of the monsters that Natalie is talking about. You're disappointed the hero falls and you know in romantic relationships people experiences all the time after the first honeymoon blush. And we see it we see the press do it with royalty. You could take Meghan Markel as an example. Or with fat cats. Martin Sorrell was taken down pretty quickly or politicians in many ways =this fall from grace, if you like, it comes for a couple of reasons. it's a reaction to the disappointment in the person. You know, Santa is no longer Santa; Neil is now a flawed human being. But it's also because you were wrong. And that's all about the individual's hurt pride and ego - the human response to that is just to lash out. You take down the erring fund manager who is now responsible for threatening your intellectual ego.

And I think in cases like an underperforming fund manager, the consequences are more than just intellectual vanity, as the financial repercussions are still severe. So, in some ways, it now becomes almost Darwinian, as people's livelihoods are threatened. Maslow's Needs are no longer secure, and the fight versus flight response kick in. And, I think we've seen this in the industry, particularly with the likes of the rogue traders. So if you think of Jerome Kerviel of SocGen or even a Nick Leeson, these guys were all really celebrated in their teams, great manager, great traders, spectacular returns and nobody questioned this. And if you look at SocGen, I don't know if you've read the case study for that. But, you know, compliance spotted what was happening, but they eventually turned a blind eye... information asymmetry was coupled with the hero worship of the front office, and everyone now puts the boots in. So management is engaged in the spoils, which is of course, why Jerome won a court action against a company who claimed to have no responsibility. But the questions actually serve a purpose Natalie pointed this out. And I think she's right she said, they play the role of a social scapegoat. So it's an emotional release valve, a convenient punch bag, if you like, in which we can cast all of our disappointments, save up all of our annoyances, and invest into some someone or something we don't like, like your like your annoying colleague. But there's another purpose there, which is they help to define the good and bad behaviour and moral boundaries. So that could be, you know, well out of the corporate space here, which is, you know, a Jeffrey Epstein or human trafficking or blood diamonds or something like that.

And I love your question, because it makes me think, but when I think of monsters, I personally don't think of financial services. Maybe I should. So people do think of Wells Fargo, or mortgage backed securities gamble, LIBOR, although he wasn't a fund manager, he was certainly associated with fund managers, Bernie Madoff. Again, many investors were duped with that. How many were wilfully blind and deaf? Some got out. They didn't trust the numbers. Others said they, you know, seemed odd, but they defaulted to truth didn't trust their gut, And many profited from all of this, so what we need to decide in the industry and you may well have your evidence, or your own view on this ...it isn't the inevitable flip side, it is inevitable, for Star managers but when you have a monster the question is 'what do you do with the monster?' sometimes we may even need to kill the monster...

in some cases, companies do exactly that, and particularly if it's underperforming and disappointing clients, shareholders, and I guess the company at large.

JB Beckett 7:52

Professional expulsion tends to be the route that I think we collectively take once we've identified or demonised an individual. And certainly I was on the show recently with David Ricketts, Owen Walker talking about that specific fund manager from Oxford. And you could see, there's such a huge push to try and not allow that individual back in to the industry. And for me, it did remind me a little bit of what happened to Fred Goodwin, after the banking crisis. And obviously, RBS as it was then, in the fact that he can't really come back in to the industry. And I think there's some analogies to be had there. But I agree, I think it's, it's, it's a means of catharsis, I think, in some ways, perhaps for us as an industry and also serves as a way to, I guess, obfuscates collective culpability if we felt there was a lot of, you know, malpractice or negligence or, frankly, at times, incompetence, right. And so perhaps it is easier if we just wrap all that into one person, and just call them a monster.

Okay, we've started on a very light note. Very suiting to this season finale episode. Let's delve further into the mind. You had said recently on another interview that, to quote ;the biggest challenges were not the well signalled reputation or operational risks, but the unconscious overweighting of IQ over EQ'. And for me, I, I touched on this with Bev Shah in her episode, but what's in your view are the consequences of an obsession with IQ. And that, I guess, overwhelming desire to be seen to be cleverer than the next person.

Nuala Walsh 9:42

Another great question, JB. And even when you just mentioned that, that last part of the question about wanting to be seen as clever, as cleverer than the person next to you, it reminds me of a fund manager that I used to work with and He used to quite openly tell me that he wanted to be seen as the smartest person in the room. And I could never quite work out, did he mean with the client, which I could understand, you know, you want to be seen as clever with the client. But turned out really that it actually just wasn't with the client. It was actually overall, it was just part of their DNA.

And I think part of this question needs to acknowledge that, that the obsession with IQ over EQ, does start with leadership and culture. And it's often a reflection of the CEO personality. So on the one hand, it's understandable in asset management, because its knowledge based and a judgement based industry that just like lawyers, or physicians, or scientists, it's necessary to justify fees. And it's part of the game, if you like, as I think it's needed there. But the problem is, of course, and Beth mentioned the Oxbridge craze, some cultures reinforce this, like McKinsey recruit only Harvard, or Ivy League MBAs, for example. And that's quite a deliberate strategy on their part. And if the individual happens to have EQ, then well, I guess that's considered a bonus. But they're hired for IQ, IQ first, first and foremost, to impress clients, that thing about being seen as smart or not stupid, because there is a difference. You know, do I want to be smart? I used to ask people and it was interesting, the answer is that it wasn't about not being smart, if that that is a huge part, but also not being seen as stupid. So but the problem I guess, with a Trump or from an industry perspective, and in our industry in particular, is that it causes, strategic, , moral and, marketing problems, if nothing else.

In terms of ego it raises is intellectual blindness. asset managers don't see value in other functions. I think HR and marketing are kind of seen as the soft skills, IT and operations are labelled techno nerds. And the problem is that the compensation and promotion structure reinforces this culture as well, creates a lack of respect for difference, lack of respect for new ideas, exactly as in the Soc Gen case we talked about earlier, , it has this created this stratification culture, of the intellectual elite, and the front office versus the back office. And given that all companies now are on the trail of innovation, the very facets that we all claim to want for diversity and lateral thinking, and the fund managers need to have the best portfolios it is a direct problem when you just have this IQ, not EQ. And on the innovation side, the lack of differentiation, I think, is huge. So we used to find that fund managers, people with good ideas, always wanted to create new products, for example. And the EQ side of that was always submerged. And is as a result, the industry has 1000s of new funds launched every year. God knows what the number is right now. And consultants and clients only want a handful,

How many products do you need, and it's not even just a product, it's this lack of differentiation, as I think we might have said, on a previous episode, people just want what’s relevant, as opposed to more - its this Paradox of Choice, which I'm sure you and your listeners are familiar with. The Paradox of Choice, suggests people can't handle this choice. And again, overestimate over compensated if IQ, people want more, assuming this high intellectual level means that you give people too much, and they can't choose and then actually, they become dumb, you know, psychologically dumb, and you get a paralysis of choice, effect which then obviously defeats the whole purpose of trying to sell more. And I think that the famous jam experiment from 2,001, that shows how 24 pots of jam at a roadside stall, you know, attracted shopper traffic. But when you gave people only six pots as an options, it led to 10 times more purchases than when 24 pots of jam were laid out. The principles the same, you see companies doing, how many varieties of ice cream do you have when vanilla sells more than any others.

So this desire to be seen as a smartest person in the room creates a real failure to think, to rethink It’s all the work that Adam Grant writes about now. Joe references soliciting external views versus internal views. It's necessary because people don't think because they don't think broadly and holistically and you end up with this mediocrity because it's unbalanced.

JB Beckett 14:50

There's almost a stigma attached to EQ relative to IQ. We live and work in a very hierarchical industry. We always have and whether that hierarchy was defined by whether the actuary sat at the top or whether the CFA sat at the top, but even the terminology of our industry, front, middle and back office tells you everything you need to know about how our industry thinks about itself. And the number of times I'd walk into a fund manager building, and they will arrange the back office in the basement, the middle office in the middle floors. And then the supposed front office, the smartest minds would get there, they do the big office suites at the top. But I think the interesting thing is, is, you know, talking to many friends and colleagues in our industry, just how many creative types actually exist, you know, hidden, you know, it's like a little underground movement, you know, people who clearly pool from EQ more than IQ, but we're all regimented and into this expectation, and I think probably the greatest learning I heard over my career was when I started going to see fund managers, it was all about the long-scripted questions, because there was a certain inherent desire that I had to appear intelligent. As time goes on many of the best questions I think I've asked with fund managers as what I would describe here in Scotland as the 'daft laddie' question that I learned, actually, sometimes the most simple question is sometimes the best question to ask at that point in time, but our industry doesn't really want to recognise that right.

Nuala Walsh 16:24

I think it's an excellent point, JB. And if you read Rory Sutherland's work, he talks extensively about how business overweight logic over psychologic meaning, And I think he's absolutely right. And he said, just because you put a suit on, doesn't mean that you're more intelligent, or more accurate or that you're more insightful about business or people. And I think what we're seeing now is a real shift. And some of the greatest risks facing the industry is around this lack of understanding of, populism, and social movements and human behaviour. And that's probably one of the reasons why behavioural science, and this need to understand how people think, and how people don't think - is being predicted, as well as one of the hottest leadership skills, in the next in the next decade. And it's the Yin to the Yang for data science.

But again, it's hopefully going to rebalance this IQ EQ question. And, you know, in many respects, I think it's a great thing. And I think it's not just our industry, as I said, management consulting, have this, you know, lawyers, or scientists, when the focus is very much on the analytical., the numbers and the logic, people forget to ask, why, why are we doing this? Why can't we change etc. And as you say, that, that creatives are put in a box in this industry, even though ironically, fund managers are tasked with being creative, and, you know, coming up with good solutions, and if they don't interact well, with our colleagues, they're never going to get the breakthrough, to define that the new product.

And the other thing is, if they don't have the skills to understand people, and to think within an IQ mentality, how are they supposed to analyse the management for the stocks, that their evaluation? So claiming that you've got 5000 fund manager meetings a year with potential,? What good is that to you, if you can't apply any EQ to understand what's going on with a particular company? So I think I think you make a great point.

JB Beckett 18:43

And that's, that takes us on to another area of which you've certainly talked about if we think this obsession, for example of IQ is actually inherently irrational. You talk about being a perpetual observer of human irrationality. And to try and make sense of the behaviour around you you play spot the bias in yourself and friends and colleagues, how can fund selectors do the same, to spot their own blind spots and biases?

Nuala Walsh 19:14

....That's not an easy question, JB as you can, imagine,

JB Beckett 19:17

none of my questions are easy.

Nuala Walsh 19:19

No they're not

Incidentally, each one of them could be a book there. You're obviously very clever and very intelligent. They're very IQ questions.

JB Beckett 19:27

I'm guilty as charged, I'm afraid sorry about that.

Nuala Walsh 19:32

Well, I think it's hard and I'll tell you why. Because I do post about bias, but there are 200 biases, so therefore, I can't give you a simple answer. How do you do it? Because I'm going to now say, classic classic behavioural science - it depends. Because which bias when, where and how - hundreds of books have been written. And you know, you know that fund managers aren't immune from bias. None of us are you neither you nor me. But some fund management biases are pretty well known. Your loss aversion is such an obvious one. And ego we know about overconfidence the disposition effect holding stocks too long groupthink, everyone agrees with each other.

And even the status quo bias not changing the investment process. I mean, a number of Chief Investment officers who just rigidly do not touch our investment process, even though they might have been you know, underperforming for years. In fact, in certain asset classes...

JB Beckett 20:26

We cannot we cannot have four boxes, there's only three boxes in our process,

Nuala Walsh 20:30

Well, correct?

Correct. And and God forbid, a marketing person might dare to suggest that maybe we might want to change some of the language surrounding a particular investment process... but the problem the problem here is it's behavioural so it goes well beyond, you know, ego and arrogance, and even ignorance, I think the problem is that busy executives just don't see the influence of these biases. The solutions are all around habit forming. And the strongest evidence for de-biassing is actually drawing attention to the different outcomes and an alternative perspective, the outside view. But when the fund managers are smart, picking the one or two that they think affects the most, and the triggers are kind of obvious, in a power-based, ego-based time-pressured, emotional environment where people have memory flaws, because it's so overloaded.

I think picking the biases that affect the most is probably the first step. I'm sure studies show that there as I say, there are four or five key biases, the one that I like, well, I like them all, actually. But one of the ones that I like is it probably effects managers and overconfident people, leaders, in the industry is this illusion of validity, where it's normal for experts and people in power to have high convictions about their jobs and is expected of our leaders.

But when the judgement is based on a fixed mindset, it really does lead to this self fulfilling prophecy. So developing the old Carol Dweck, growth mindset isn't a bad way to start. So if you imagine making the same stock selection decision, for a competitor or fund manager, or even just for a competitor as a strategic decision, does sometimes help. It's not always as effective averaging group estimates But it is one that people do seem to point to quite a lot.

Be aware of the endowment effect. We all love our own ideas, like your writing, you love everything you write, and because you own it, and you've invested in it, and it's like the IKEA effect, or what I've made, I've built therefore, and I value it higher than anything else. And the problem with this is that people don't accept other views or adjust. I read a study recently that showed that people fail to shift their opinions, at least 70% of the time, which is quite a phenomenal, phenomenal figure, They will be adjusted 30% of time, So you know, broadening your decision frame and using this kind of disconfirming data to update your belief is kind of basic, and we know it but we're not in the habit of doing it so we could wax lyrical about all the things we should do on could do, but we don't do it. And I think it's up to the organisation to shift the environment.

So you know, for overconfidence making accountability salient in an asset class really will help to normalise different opinions. And I wrote about this in an article in Forbes quite recently. But it's ....using these techniques, because there are so many reasons why we just don't listen to anyone else. And we love our own opinion, I can understand I love mine, you love yours, you know, the listeners love theirs. For the price of it's huge. Because when you have that, and, particularly in a high alpha environment where you have this illusion of control, and most Alpha types do think they're in control, and don't have this illusion of invulnerability, that nothing's going to happen to them and nothing goes wrong. And this is a real problem obviously in high performance teams. So from 200 biases, pick the one or two or three that appeal – and note their fabulous names. There must have been developed by marketeers but they've got these great names and it makes it easy to relate to and to pick up on and advertise Fund managers just as much as anybody in the fund management industry really can help improve their own decision making and can have a better life less regret less remorse by focusing on these. I'm sure you have a few in mind yourself that that's it that you focus on.

JB Beckett 24:38

oh I have so many mistakes and regrets maybe that'll make the uncomfortable fourth book but we'll see there's certainly plenty to fill in there if I if I want to do that. But taking a guess those biases and blind spots and then adding the concept of time, so taking this really you know into the heuristic takes us to this thing that we call the 'peak end rule' about how we feel about the decisions that we take. And then again, over time, how we felt about them at the peak, and then again at the end. So I was wondering how can fund selectors use the peak end rule, to their benefit to be aware of it, especially I think, when selecting managers or reviewing past decisions?

Nuala Walsh 25:24

it's a phenomenal tool for people to remember, at the end of the day, it basically says the, as you say that clients, fund managers, people, remember the most intense moments of an experience good or bad. And it's all about memory and relates back to the experiencing versus the remembering self. And when you have the experiencing, Daniel Kahneman argues that the experience itself differs from the remembering self. So if you consider your own experience of; grief, lockdown, or honeymoon, the point is that at the moment of might, at the time, it might have felt either amazing or awful. But over time, you remember it very differently. And the more salient the experience more easily, it's retained in memory. So if you relate that now to to the fund manager, I think what really matters as a fund manager who's got burned, so if I wanted to review his past decisions, say he got burned by Citibank back in the 1980s. And he never buys them again. So in that way, it's important not to penalise managers and to remember that actually, that's what your data what this is, that your experience was so bad, so intense, that that's what you're remembering.

And it's a marvellous lesson because Citi Bank as an example might have completely, you know, revolutionise their team or brought in a whole new operating structure. So you can't judge, you can't judge based on the past when we say past performance ....you know, is no guide to the future. And and this is an exact example of that,

I think the only way that a fund manager can have a client leave on a high is if he's got outstanding performance, let's face it, so he can use it but he was only on the premise that he's left a client so well rewarded..... that's the memory that the client would have over what is a very useful bias that a lot of companies now use to their benefit.

JB Beckett 27:22

Is there are some transference that occurs the selected a fund manager, it then tanks for the next six to 12 months, you know, their decisions are being questioned by colleagues, and then when they go back in to that next meeting with the fund manager, and usually, frankly, will roast them on hot coals, is that actually transference of their own emotions and inability to deal with the outcomes of their decision? You know,

Nuala Walsh 27:49

It's a great point, I actually think it is, and you know, memory is that peak and effect. It's so engrained and chiselled in your mind, it was so painful that that's exactly what happens. And people you know, people struggle to forget that. There's nothing worse than a burned client either. You know, people never, I used to always think, people never forget what you do on them or for them. So can work positively as well. So, you burn someone you remember, think about yourself, you will remember anything that someone does for you, you have in the positive sense as well. And that's why this is such a powerful tool.

So positively or negatively, people will remember that yes, I know, memory distorts and we're subject to you know, distortions to flawed memory which become false memories thanks to, fake news. But at the end of the day, the intense moments, state stays with you,. I just came across something recently that demonstrates how these emotional events stay long and memory and they shape the subsequent actions. whether it's voting, hiring, or firing managers, but in this case, after 40 years on the run for eight armed bank robberies in Sydney. It was about three years ago, a chap was apprehended in Australia.

But interestingly, it was the victims memories that didn't fail. So the the bank robber, you know, just remembered his patchy statements, but the victims remembered every single bit of that experience, , the police said they provided clear and vivid statements like they were recounting something that had only happened to them yesterday, though the intensity of memory when the negative memory and particularly a negative memory can stay there a very long time. So you're right, it's a it's a safeguard for the fund manager to bear that in mind.

JB Beckett 29:44

And quite handily, takes us into the realm I guess of criminality. And I guess my last question for you before we get into the, into the fun stuff into the rapid fire round is when a fund selector for schools and to see that fund manager or investigating new manager or doing the RFP or doing the beauty parade? Do they need to start thinking a little bit more like FBI agents in those meetings? And indeed, when investigating when things go wrong?

Nuala Walsh 30:16

it I would say that that's a great suggestion. I would probably think that most think that they do that anyway, JB, I think they would probably argue that they interrogate, forensically analyse, they find meaning where there is none. They don't take things at face value. But we know that the reality is slightly different.

They do that to some extent, but I think, you know, it's never.... about what it’s about and it goes back to my point about looking at what is logical versus what's psychological? You know, take a detective who investigates a robbery and interviews the neighbours, he discovers that the family dog didn't bark. So does he conclude the burglar is known to the dog, the burglar silenced the dog, or the neighbour is hard of hearing. You know, like a journalist, it can be any of those interpretations. And I think the problem now is that fund managers like the rest of us are so overwhelmed, cognitively, so distracted, so deluded by bias, that we rush to judgement and and sometimes just don't go that extra mile, do this do extra due diligence, to find out what really is happening, and how well are they reading those corporations? Are they doing more than just analysing the accounts, you know, attending management interviews, is really for me is all about understanding the nature of human behaviour. And whether it's, shifting risk attitudes, or you're one of my other favourites is preference falsification, when people cover up their real feelings, and opinions on matters for a host of reasons. And they basically falsify their preferences. How often is that happening? Do companies, or did fund managers analyse groupthink levels enough? do they do? I guess, not quite a bias? Or maybe some kind of behavioural diagnostic on these companies? They say they do.

But to your point, do they do a forensically as an FBI agent would do? No, because they don't have time there and maybe decider overconfidence, as they think, well, I've gathered all of this information and to your earlier question on a very clever individual. So therefore, I don't have to do this. And I've got such great intuition I get I can read this company. And that happens all the time. That is the Achilles heel of many, not just a fund manager, but many leader and CEO as well,

JB Beckett 32:35

I think there is just this burning desire for intellectual affinity, those who tend to focus much more on quantitative analysis, see, well, this is always the inherent flaw in qualitative analysis. It relies on people interaction, and people lie and mislead, etc. The way I've always tried to view it. And I think the reality is Nuala, that fund selectors don't nearly enough, do the forensics at the point of sale, or even before the point of sale. They're great at doing a forensics when it all goes wrong. And I think personally speaking, fund selectors would do well, to treat that new manager opportunity, as if investigating a crime scene, you know, the murder has already taken place, even though no money has exchanged hands, if you actually approach it that way, rather than, which... what I think tends to happen is that the fund selector and certainly I've been guilty of this, through my career, is that you're both trying to assess the fund manager in front of you for your clients. But at the same time, you're trying to build affinity and you're trying to build a working relationship. Because generally, the view of qualitative analysis is the better the relationship, the better the flow of information back to yourself.

Anyway, I reflect this in hindsight, I don't I don't absolutely practice at all anything they preach. I wish I I wish many a time. I wish many a time I did. But that's that's a good, that's a good point to stop. And we'll finish with the rapid fire round of 10 questions. Really, really easy stuff. Nuala. As I'm sure as you have listened to other guests agonising over some of these.

If you're ready, we shall begin.

Nuala Walsh 34:18

I am ready.

JB Beckett 34:20

Great stuff. The first question is bull or bear?

Nuala Walsh 34:24

Bull.

JB Beckett 34:25

The question two.. is Bogle or Buffett,

Nuala Walsh 34:29

Buffett because I think he's great. They're very smart,

JB Beckett 34:33

Smart people you see. Exactly but do you think it's more IQ or EQ with Buffett?

Nuala Walsh 34:39

I think it's both. I read something recently that had 15 wisdoms of Warren Buffett. Actually excellent. Very, very, very inspirational

JB Beckett 34:49

Question three profit or planet?

Nuala Walsh 34:52

I'm going to counteract every other answer you've had and say profit.

JB Beckett 34:56

Interesting. The twittersphere will be ablaze

Nuala Walsh 35:01

I just thought it'd be controversial. It's never one or the other it's always both.

JB Beckett 35:06

Question four, divest or engage?

Nuala Walsh 35:08

Engage.

JB Beckett 35:09

Question five, lower cost or better value?

Nuala Walsh 35:12

Oh better value. That was easy.

JB Beckett 35:14

Question six supertankers or boutiques?

Nuala Walsh 35:17

Oh I love super tankers, super tankers. I've only ever worked for super-tankers. Sorry boutiques.

JB Beckett 35:23

....I'm not gonna bring my personal views on this one. I'm supposed to be neutral. This is the whole point of the show. Right? The next question is star managers or team players?

Nuala Walsh 35:32

I'm actually going to go for Star managers because I think they still serve a purpose. It's not that I don't agree with team team players but I think star managers still you know provide a purpose.

JB Beckett 35:42

Wow and I'm and I'm really surprised given the Aberdeen heritage one of the first houses I think that really kinda pushed the team model over you know, the individual.

Question eight public or private?

Nuala Walsh 35:54

Private

JB Beckett 35:56

Question nine, high growth or stable income?

Nuala Walsh 35:59

I'm old, stable income.

JB Beckett 36:03

If we can find it that's I think that's gonna be the interesting one. And the last question, which is my favourite everyone on the show knows it's my favourite. I make no apologies for it is socialism or free markets?

Nuala Walsh 36:15

I'm going to go with free markets.

JB Beckett 36:18

Many in our industry do unsurprising although I have had a few guests surprise me on that one. So. So there you go. And that just leaves the bonus round. King Kong or Godzilla?

Nuala Walsh 36:30

Oh Godzilla.

JB Beckett 36:31

Brilliant. Excellent.

What a great What a great one to end on.

I know it's the one I'm always hoping I mean, if I trailers showing Godzilla, please someone just ask the B-movie question. Thank you. And that marks the end of the interview nullah you have survived the new fund order, just want to say thank you very much for delving into the into the dark corners of the the fund selector mind.

Nuala Walsh 36:55

Well thank you for a fabulous season, JB and a great finale. So thank you very much. It's been it's been fun.

JB Beckett 37:02

You're very kind thanks Nuala.

Please don't forget to like and share and subscribe you know, click the subscribe button. new podcast every week with a new guest. Stay tuned.

A big thanks to you dear listener for tuning in. Brought to you by my sponsor, Allianz Global Investors. And a warm thanks to today's guest. Legally, I am compelled to remind everyone that all views on this podcast are of course independent and did not belong to any affiliation or organisation. Just in case that was in any doubt. Tune in for the next podcast every two weeks from

Computer 37:39

the new fund order.

JB Beckett 37:41

Please subscribe, share, like and comment. Let me know what you think and what you would like covered in future episodes. Until then... stay safe and keep it left-field!

Transcribed by https://otter.ai